Success in medical and biomedical textiles markets requires established expertise and a long-term commitment.

Success in medical and biomedical textiles markets requires established expertise and a long-term commitment.

If you want to talk about today’s medical textiles markets, it’s necessary to go beyond the end product—and even the finished textile—and look at what goes into making that textile. And as much as highly engineered materials are now well established, change and growth through constant innovation is a fundamental part of the equation. Industry participants point to a variety of developments that have had a profound impact in the business of medical and biomedical textiles.

Scalable

One market change, says Kerem Durdag, CEO, Biovation LLC, Boothbay, Maine, is that new technologies in medical markets can get integrated into “scalable manufacturing realms” quicker than before. This is having a massive impact, he says.

“It is pushing solution providers to be very close to their markets and end customers and not take anything for granted … especially since the competitive landscape (and flux associated with that) is very dynamic and vibrant. In that regard some of our health care products that are in the FDA-approval pipeline (blood pressure cuff shield product and our advanced wound care dressing) contribute positively to this ecosystem.”

Durdag’s company designs and manufactures PLA-based nonwovens for infection control, packaging, hygiene, advanced wound care and other specialty applications.

Unique

Peter Gabriele, vice president, research and development, Secant Medical® Inc., Telford, Pa., says the most dramatic change in implantable textile-based devices is the latest technologies for addressing the uniqueness of each application’s specific performance because it is now possible to build unique structures within a fiber, using high-definition microextrusion.

“In short, the technology provides the ability to produce hybrid fibers with differing characteristics. Inner fiber can be built for strength, while the outer fiber can possess a different property such as an aesthetic, melting property for better bonding, inertness with the body to reduce inflammation or barrier properties to provide a fluid barrier.”

The company says it merges “traditional biomedical textile technology with regenerative medicine technology.”

Multiple use

David Gray, MedTextra LLC, St. Paul, Minn., offers a different perspective, citing a market move toward more generic materials and structures that can cross over specific fields of use. “Rather than designing materials for each individual field of use, individual materials that have utility in multiple environments cut down on both design and manufacturing costs, a significant driving force in the medical field generally,” Gray says. MedTextra has developed a fabric system that stays moist and self-cleaning for extended periods in all environments.

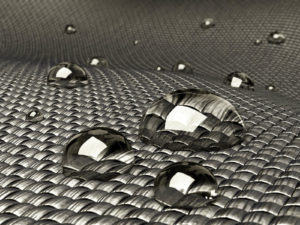

Better fluorocarbon

There is one change—basically “old news” now, according to Brian Rosenstein, chief coordinating officer at TSG Finishing LLC, Hickory, N.C.—that has swept across all markets. In fact, “I’ve never heard of anything that’s had such a sweeping impact,” Rosenstein says. He’s referencing the government mandate (U.S. EPA 2010/15 PFOA Stewardship Program) to eliminate the manufacture of C8 fluorocarbons. This is the chemical that makes textiles water and stain resistant; virtually all textiles used in most medical environments must offer this protection. TSG and other finishing companies must now use C6, which will work, but you have to use more of it.

“The problem is that if you reduce the chain length in your fluorocarbons, it minimizes performance and is harder to manufacture. So we’re using a ‘better’ fluorocarbon, but it costs more to produce, making it more expensive.”

Smaller fibers, smaller devices

From Rosenstein’s vantage point, there’s been sweeping change; for fiber manufacturer RxFiber LLC, the dramatic difference is smaller—smaller devices, that is. This has created a demand for microfibers, such as the company’s RxFibron HT™.

“Medical device companies are starting to become creative in the approach to the device design to mimic the anatomy as best as possible with the materials available,” says RxFiber president Robert Torgerson. The company, based in Windsor, Calif., has developed a fiber that shows a 50 percent increase in tenacity, is half the size of the current 40/27 PET and is a more pure polymer.

“Because fabric [made with this fiber] is so much thinner, it can be functional for many applications: vascular, cardiovascular, neurology, hernia repair, wound management and orthopedics,” says Torgerson.

What’s got “the buzz?”

In the midst of so much innovation and the promise of novel materials ever-present on the horizon, where’s “the buzz” for industry players?

One hot point is tissue engineering, made possible in part by a resin called

poly (glycerol sebacate) (PGS) that has shown “tremendous promise in the field of tissue engineering and regenerative medicine,” says Gabriele.

“PGS is a bioresorbable elastomer that is nonimmunogenic, noninflammatory and antimicrobial and can be applied to implantable textiles as a coating to incorporate regenerative medicine technology with traditional biomedical textile technology,” he says. Gabriele believes this technology has the potential to change the future of implantable devices.

For Durdag with Biovation, advanced wound care stands out, but “Advanced wound care needs to straddle a complex world of needs, desires and price points, and it is very unlikely one product will encompass all of them.

“It is an interdisciplinary product which needs not just textile manufacturing know-how but a deep knowledge based in wound care modalities [and] biochemistry and an understanding of the entire health care system,” says Durdag.

MedTextra’s Gray points out that new materials “have been more strongly recognized as part of the actual medical environment and not merely a convenience or decoration. With this recognition comes the awareness of the fabric’s actual contribution to procedures, results, treatments and performance in the practice of medicine.”

Torgerson at RxFiber has noticed a buzz for more durability, too. “Patients are living longer and staying more active so devices have to have the same sustainability.” Smaller devices make it possible for more patients to have transcatheter procedures versus a surgical procedure. “This is a good thing,” he says, because of fewer traumas to the patient.

The other buzz is that the FDA is beginning to recognize the need for medical grade fibers and fabrics, including the ability to demonstrate that the source supplier manufactures under strict ISO 13485 guidelines.

A similar FDA crackdown on dyes indicates a focus on the industrial suppliers of fibers and fabrics. This means that “standards, such as test methods, process calibration and process validation to ensure process repeatability, will be more rigorous,” Torgerson says.

For TSG’s Rosenstein, it’s all about protection—more than ever before. “I do believe that hospitals are fighting an uphill battle and are going to need to upgrade their textile products in order to do their jobs successfully,” he says.

Gray also points to the control of medical environments. “The provision of any materials that can help eliminate antibiotic resistance in microbes and help control ambient conditions on patients to promote treatment and healing are fundamentally important, especially when they can be provided by a single product or technique,” Gray says.

MedTextra’s fabrics and textile system are effective for an array of applications and fields of use, from respiratory face masks to hospital surgical tool tray liners to wound care.

Predicting the future

The technology, material or application that could have the most significant impact in the future is also a matter of debate. Several are in the running.

Torgerson expects longer-lasting biomedical materials to be important, but “most companies do not want to take the risk to do the long biocompatibility studies on next generation materials that may go into device innovation,” he says.

For instance, polyester fiber has been used extensively in fabric structures for devices. The current industry standard, a polyester (semidull containing a whitening agent–titanium dioxide) will break down in the body over time. “If we want devices to last longer for patients that are surviving longer we need to look at other alternative polymers that are the backbone for devices,” says Torgerson.

Durdag believes that two technology paths will significantly affect the landscape for medical textiles. One is the ability to print electronic circuits on nonwovens so they can act as a flexible printed circuit board. This, he says, will be “a monumental sea change.” The other is bioresorbable nonwovens that can act as tissue scaffolding and a vehicle for drug delivery. “This will contribute massively to patient needs that are not currently addressed,” he says.

Fiber engineering that supports regenerative medicine was identified by Gabriele. “This will allow medical textiles to be created with an even higher level of specificity, in effect providing the ability to customize every aspect of the fiber used to develop a structure,” he says.

Many changes are being driven by environmental standards, says Rosenstein. It’s also the reason that a lot of textile manufacturing is coming back to the U.S. because some international producers are not capable of meeting these standards—or quality, he believes.

Identifying barriers

As much as medical textiles have experienced a generally robust market, there are barriers that pose serious challenges, particularly for smaller businesses. Durdag says regulatory inefficiencies have a big impact on his business.

“To that end, the FDA has to—let me emphasize, it has to!—have better, more streamlined and much more progressive methodologies in place for dealing with smaller companies that want to get products to market,” he says.

Gabriele adds, “Getting FDA approval can take a number of years, which has traditionally created a slower environment for new advances in the industry.”

“The need for small innovators to provide repeated, extensive and expensive evidence of performance of technology across multiple product lines,” is a problem, says Gray, “even though sophisticated single procedure testing is sufficient for the ordinary medically-skilled technologist.”

Larger companies have shifted the burden onto small innovators for exhaustive testing, he says, and the “not-invented-here” mentality at larger corporations will require a cultural change to put “scientists and technologists in interactive contact with outside innovators,” Gray says.

Torgerson is concerned that some medical device companies still use industrial-grade materials to save money. While it’s expensive to manufacture and get devices approved, it’s “a huge risk to use materials in a device that does not have full traceability of the materials,” he says.

“The industrial material may be sitting on a shelf for extended periods of time before being purchased and then additional time has passed before the material is processed, which could lead to defects in the device function,” he says. He’d like to see the FDA take a hard look at this issue.

Taking stock

Even so, there’s much to celebrate in the medical textiles industry, says Durdag—new processes, materials and approaches. But, he says, “There needs to be more mutual collaboration between the more mature and global ‘footprint holders’ and the younger brethren because the markets can be accessed (especially global ones)… but only in cooperation with each other.”

Durdag also stressed the need for meeting “moral and ethical obligations to care for our planet.” Meanwhile, there is the pressure to focus on “bottom pricing without considering the entire life cycle costs,” he says.

Rosenstein agrees that environmental concerns have impacted change, but cautions that the people making the rules need to have a better understanding of the subject. “Multiple institutions writing individual standards often

leave the manufacturers lost. Government municipalities, certification organizations and private groups working independently lead to conflicting guidelines,” he says. “A single governing body that oversees standards could address this problem.”

Gray is concerned about inertia in industries that are not as “sexy” as consumer electronics. “It has been difficult to convince manufacturers that a product that is merely more comfortable, looks better and is more effective in reducing disease transmission is commercially more important than an app that can inspire more videos of cute cats,” he says.

From Gabriele’s viewpoint, it’s the market that is driving fiber technology advances, pushing toward the next generation of implantable medical devices, composed of bioresorbable materials, such as collagen, and enabling regenerative medicine.

“This next-generation technology has the potential to positively impact the entire medical industry, providing patients with better health outcomes, providers with better medical treatments and insurance plans with reduced costs when treating chronic conditions.”

Janet Preus is senior editor of Advanced Textiles Source and a contributing editor to Specialty Fabrics Review.

TEXTILES.ORG

TEXTILES.ORG