At the start of each year, Specialty Fabrics Review surveys its readers to learn about current trends and business challenges and opportunities, to take a snapshot of our industry. As anticipated, inflation, the supply chain and hiring remain the top concerns, but revenues are up and growth plans are in the works for most respondents.

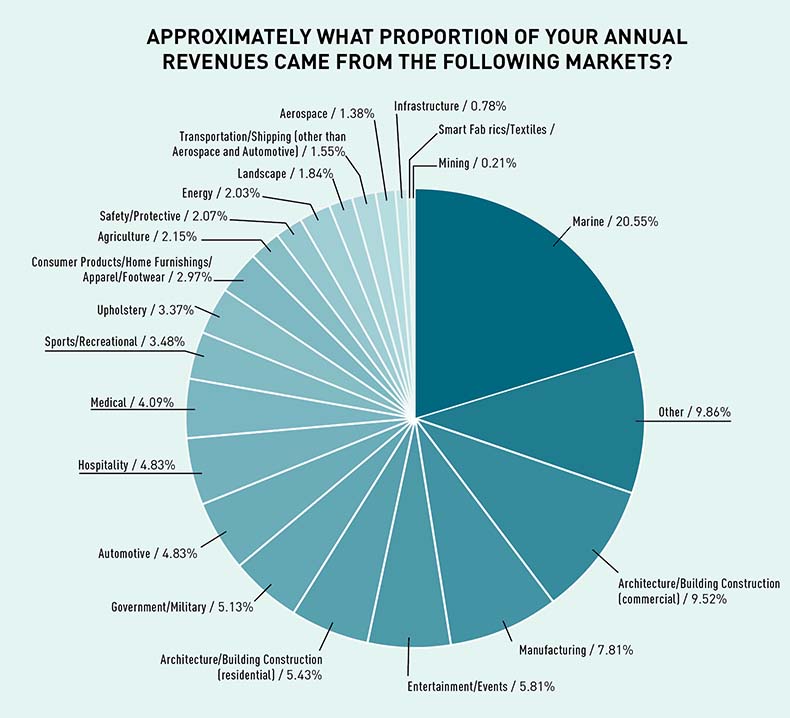

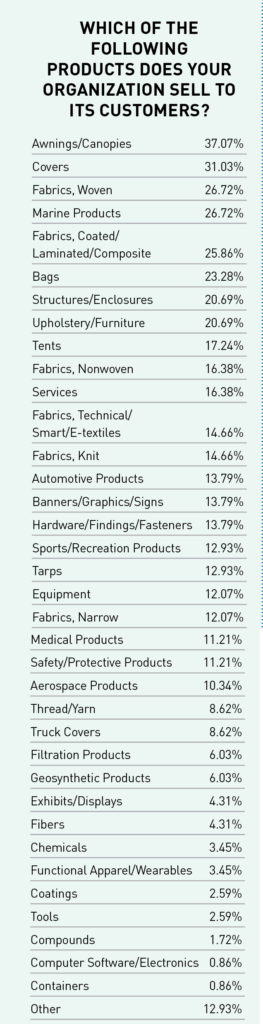

We had 159 firms take our survey this year, representing a wide array of company sizes and markets in our vast industry, from those with revenues below $500,000 to those with more than $10 million in sales. Workforces included those with four or fewer people to those with more than 10,000 employees—though two-thirds of respondents have fewer than 50 on staff. The biggest segments of respondents were from end product manufacturers (36%), suppliers (14%) and marine fabricators (13%).

Companies sell to a broad range of markets, from aerospace to upholstery. Even though the makeup of each year’s survey takers is different, the 2023 responses were similar to last year’s in many respects: Revenues and prices are up, and many companies plan to expand into new markets. Last year’s top concerns relating to costs, price sensitivity, labor and supply chain delays are still around this year, just ranked slightly differently.

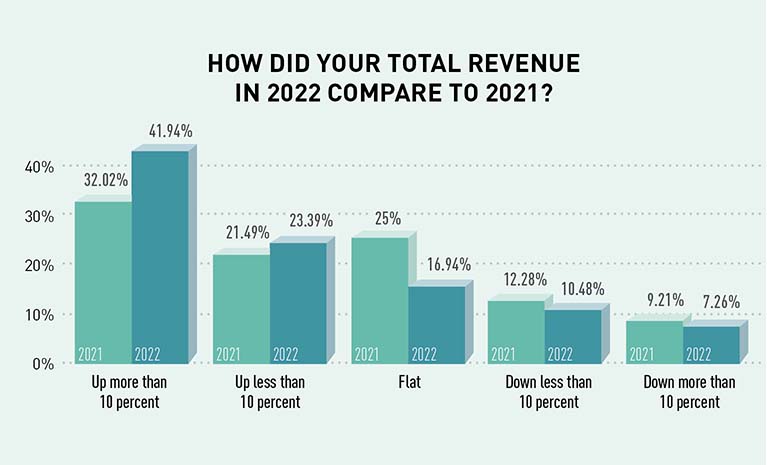

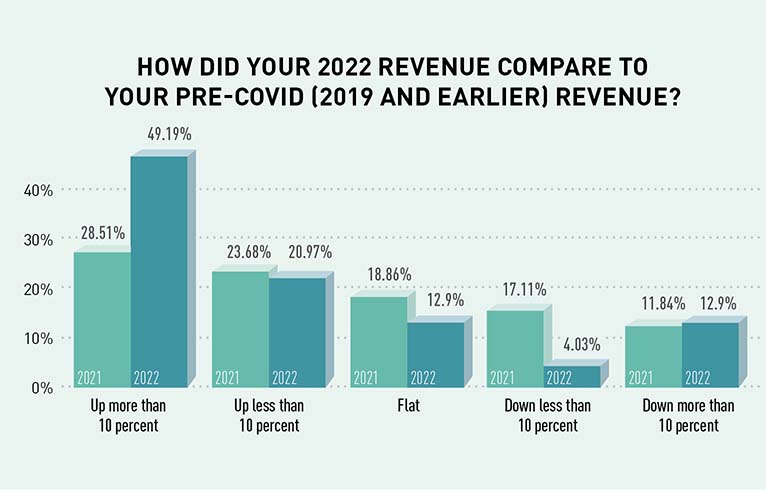

This year’s survey found that revenues were up in 2022 for 65% of respondents (compared with revenues in 2021), and for 70%, are even above pre-COVID figures. About 18% reported revenues being down in 2022, and for nearly 17% they are still down as compared with the pre-COVID era. One respondent noted, “Demand in (the) hospitality sector remains suppressed.”

Other concerns include cheap knockoff products and intellectual property theft in Asia, regulations, finding suppliers who will deal with smaller manufacturers, “Cash flow. Getting paid on time,” and even the loss of a few yacht customers who can no longer enter U.S. waters.

Inflation and recession worries

Uncertainty affects businesses significantly. Last year, people were somewhat concerned about how the war in Ukraine would affect business. This year it is the possible recession. Unlike last year, most companies in 2023 reported that the war in Ukraine is not affecting their business. But last year during the survey period, the war was front and center in the news every day and there was much insecurity concerning how it would affect energy prices, markets and shipping/supply chain logistics.

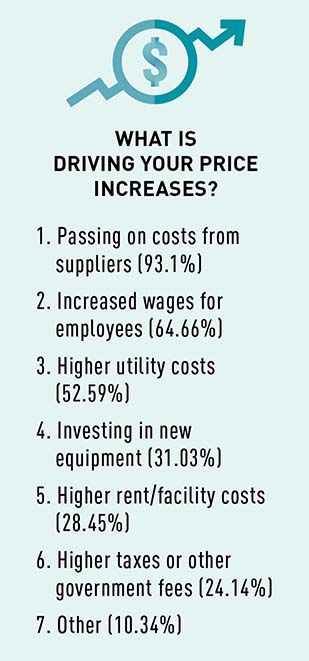

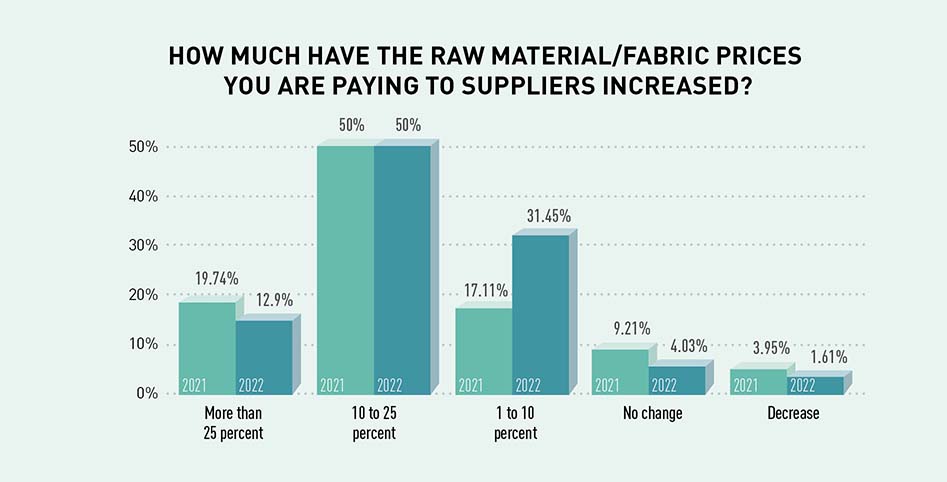

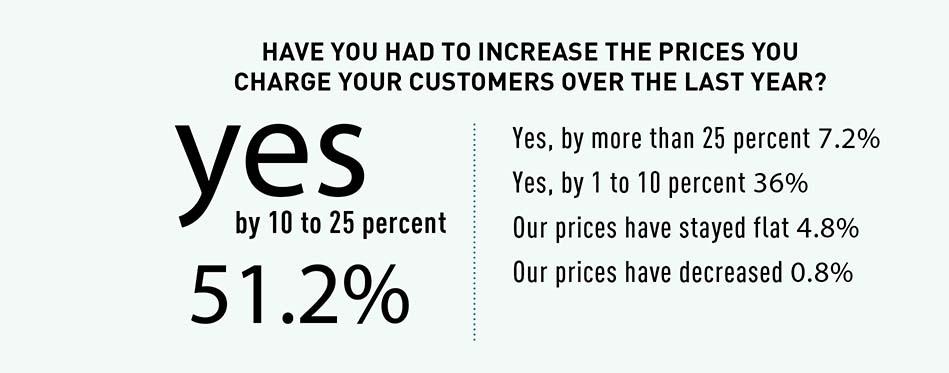

The aftereffects of that invasion last February—inflation from the higher energy and grain prices that continue to ripple throughout the global economy—still have people’s attention, however. Companies are paying more to employees and suppliers and spending more on utilities; plus, they’re worrying whether they can keep up with the “rising cost of living,” one person specified. Ultimately, businesses have to pass at least some of those increases on to customers by raising their prices again (94%, with 58% having to raise prices by at least 10%), which may be why customer price sensitivity has reached this year’s top five concerns. Last year, 92% raised prices some too, with nearly 63% raising prices at least 10%.

Though the forecast for a recession was pushed later than the first quarter this year, as had been predicted, the “planned recession” was still bringing about “fairly conservative buying patterns,” one person reported. Another listed the “changing retail landscape” and “overpurchasing by customers in 2022” as affecting sales this year.

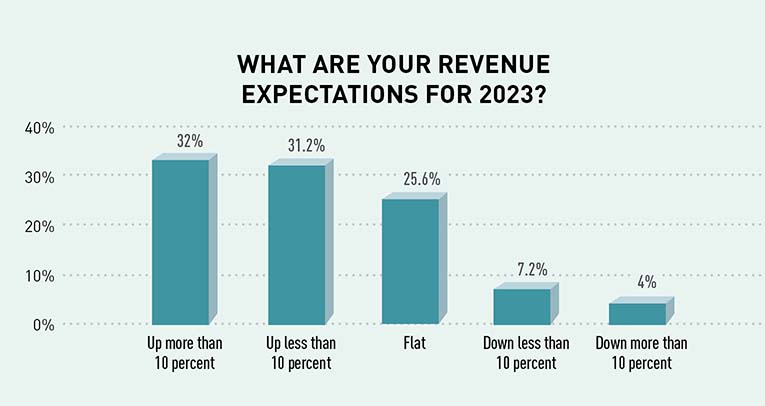

The good news is that 63% of our survey takers expected revenues to rise in 2023, with almost a third projecting them to be up more than 10%. Flat revenues were forecast by nearly 26% of companies.

But maybe we can consider an element of “flatness” to growth to be cautious optimism as people wait and see how the predicted recession shakes out. Some prognosticators think it might not be as bad as previously expected, but only time will tell whose theory turns out to be correct.

Expansion plans

Most respondents let us in on their forward-looking plans over the next two years, with almost half working on new product lines with their existing capabilities (49%) and entering new markets (47%). Such additions should help those businesses concerned with growth (or lack thereof) in their existing markets. Forty percent plan to expand domestically. Few expect business to contract or that they will divest.

Going hand in hand with those growth expectations, the most important strategic areas for companies in the next two years include product diversification, improvements to supply chain/logistics and employee development programs. On the latter issue, some company representatives reported having difficulty finding people interested in taking up the trade and then inspiring them to better their career, especially the youngest generation entering the workforce, who may not have learned any kind of shop or sewing skills in school during this era of standardized test prep. Concurrently, one person noted, “Trade has lost a ton of trimmers, and not too many new people [are] coming in.”

Fortunately, nearly 83% reported their staffing levels as up or unchanged from last year, but with “finding skilled labor” moving to the top of the list of concerns and many companies having future expansion plans, it’s clear why labor retention is so important.

New facilities are in the plans for about 16% of respondents and acquisitions for nearly 20%. The U.S. Federal Reserve’s attempts to keep inflation in check by raising interest rates means that borrowing costs more, which also factors into people’s inflation concerns.

Regardless, new equipment is planned for 34%, and nearly 23% are exploring some kind of automation, a purchase or rental, which can keep the work moving, even in a tight labor market. (Elsewhere in this issue, several companies describe what to look for when considering automation and how it can help increase productivity.) Automation reduces the mundane tasks workers need to take on, allowing them to focus on the parts of the job that benefit most from a human’s skill and knowledgeable judgment, which, even though AI garners much attention nowadays, still cannot be replicated by machine. And those people at your helm, and how you empower them, are your greatest business assets, no matter what contingency plan you have to pivot to in an ever-changing business climate.

Cathy Jones is the senior editor of Specialty Fabrics Review.

Want to hear more about the state of the industry? Join ATA for the State of the Industry webinar at 1 p.m. EDT July 27. Click here for more info or to register.

TEXTILES.ORG

TEXTILES.ORG