The fact that a survey captures a moment in time was never more apparent. Advanced Textiles Association’s (ATA’s) annual State of the Industry survey occurred during the late February and early March period when the proposed tariff rules were changing daily, in addition to other policies. The uncertainty created by that tumult came through loud and clear in the concerns and comments people listed on their entries. More than a third of survey respondents cited “tariffs/exclusions” as an issue affecting their business.

The annual survey asks people’s opinion about 21 different issues. The top worries are pretty consistent year to year, so whatever changes is notable. This year, tariffs are newly appearing in the Top 6 concerns.

The questions concern business demographics, revenue forecasts, issues affecting companies and their plans for the future. Roy Chism, board chairman of the Chism Co., San Antonio, Texas, and Advanced Textiles Association board chairman, noted that the survey responses overall show how the industry’s businesses fit into the larger economy: “ATA’s diverse membership, end products and markets served mirror the economy—up overall, some markets more than others, with some segments flat, all facing both labor and inflation/expense challenges while remaining guarded about the potential of uncontrollable events.”

The respondents and their outlook

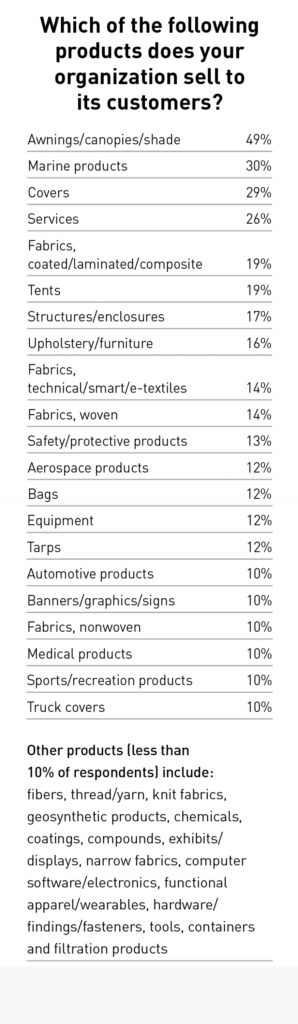

For context of the opinions, the survey respondents represent small businesses, with a third of them having just one to four employees and another 25% having 20–49. Only 18% of survey takers have 50 or more employees. The businesses include Advanced Textiles Association members and nonmembers both. About half are end-product manufacturers and about half are sellers of shade products; 30% sell marine products and 29% sell covers. Fifteen percent of respondents are suppliers, 13% marine fabricators and 11% are in the engineering/architect/design firm category. More than a quarter offer services. The top markets include residential (29%) and commercial construction (46%), government and military (45%), marine (38%), sports/recreation (35%), manufacturing (32%), hospitality (28%) and safety/protective (26%).

Their outlook: About two-thirds of respondents expect their revenues to be up in 2025. Only 3% expect them to decrease. Almost half had revenue increase in 2024, but almost a third showed a decrease. (See revenue charts at right.) About one-third expect them to be flat for 2025, higher than the 24% who had a flat 2024.

A few people left us comments we could use on the record and responded to follow-up questions about how their year went and how they hope 2025 will go.

Patrick Howe, founder and CEO of Wholesale Shade, San Marcos, Calif., said, “2024 was an interesting year for sales. Our overall sales were flat compared to 2023, but some customers were way up and some were way down. I think the lesson is that you wake up every day to a new reality. What worked yesterday may not work today. You need to keep your finger on the pulse of the market, your customers, their customers and be ready to adjust.”

J. P. George, business manager of Presto Geosystems, Appleton, Wis., shared, “The geosynthetics industry was expecting a boon with the IIJA [Infrastructure Investment and Jobs Act] projects push that was not realized by many.” Looking long-term for this segment, George noted, “To grow and evolve, our industry must ensure minimal quality and sustainability standards so the end client may build with quality materials they can trust.”

Business is good for Rebecca Segrest, owner of marine fabrication business Off Season Canvas, Brunswick, Ga. “I opened in June

of 2022 and have had no shortage of business,” she said. “The market is ever growing, and there are a limited number of companies sewing, especially for custom marine products. I’m pleased I got into this industry and look forward to our company gaining experience and sustainability in the marine textile industry.”

Stone Vos Awnings, Brooksville, Fla., focuses on custom RV canvas. Company president Ingrid Balsters shared that 2024 had a significant downturn, but she is staying hopeful for a better 2025. “I’ve spoken to many businesspeople in the RV industry regarding last year’s numbers, and I can’t tell you the number of folks who said that it was like someone turned off the faucet and the money stream all but stopped,” she said. Some of them speculated it was due “to it being an election year,” she said, “so much uncertainty and bad news that consumers waited it out to see what was going to happen.”

Top concerns relate to chaos and costs

Almost half of the people who left a comment relating to their concerns cited in one form or another the chaos around the policies coming out of Washington, D.C., at the time. Basically, financial uncertainty is bad for planning, regardless of a person’s political party affiliation.

Overall, respondents’ biggest concerns focused on costs, a major focus for people running businesses. Concerns included inflation, customer price sensitivity, the higher cost of wages, increased shipping costs and tariffs.

The worry about inflation mirrors the preliminary March results of the Index of Consumer Sentiment done monthly by the University of Michigan, where the “expectations for the future deteriorated across multiple facets of the economy, including personal finances, labor markets, inflation, business conditions and stock markets.” And the Canadian Federation of Independent Business’ measurement of business confidence tanked to its lowest level over the two decades that the monthly measurement has been taken, due to the potential for retaliatory tariffs.

During last year’s survey period, inflation was on the decline but wasn’t dropping as quickly as hoped for. This year, it was lower than it was at last year’s survey time, but the concern still topped the list.

Lynette Navarro, owner of Custom Canvas Co., Grover Beach, Calif., said, “My work board says we’re busy. Our bottom line says we’re not as successful as previous years after the bills are paid. Many challenges are converging at the same time, and it definitely has me concerned. I’m thankful spring comes no matter what but will definitely be preparing for the next, leaner winter just in case and hoping the next price hikes from suppliers are gentle.”

Respondents’ opinions on price hikes were similar to last year, with price changes not as drastic as two years ago. Forty-five percent had to raise prices by 1%–10%, although the 10%–25% price hike group was not far behind, for a total of 83% of businesses raising prices. However, no survey respondents raised their prices by more than 25% over the past year.

More than 90% of those who raised prices did so because costs went up from their suppliers, 68% because of employee wage increases. Pending tariffs could also have an effect in coming years as domestic businesses decide if and when they have to pass on those price increases to customers, and reciprocal tariffs could price American products out of international markets.

On costs, an anonymous survey respondent said, “This is the first time in 30 years I can recall all the minor and major cost challenges hitting at the same time. It definitely has me worried.”

Likewise, another person noted, “Higher gas, health care, steel, shipping, actual increases from suppliers since 2020, office supplies increased, electronics increased, maintenance costs increased, water costs increased 30%, everything.”

Labor scarcity

Adjacent to the higher cost of wages is labor scarcity. Many advanced textiles businesses find it’s a challenge to attract employees to a manufacturing job or craftsman trade and then have them be “willing to put in the time and effort to gain the experience needed to move past entry level,” one person noted.

Mark Minor, owner of Ontario Marine Canvas, Seattle, Wa., said, “Our ongoing struggle is to find young people interested in marine canvas fabrication. Very few have any previous experience, and there is a lack of opportunities to study this trade. Being happy to train employees is a bonus for any business but particularly for niche trades such as marine canvas.”

For some, the labor problem even holds the business back. “The business is steady for the number of employees that I have,” said Rick Berkey, owner of Rick’s Custom Marine Canvas and Sail Repair, Cornelius, N.C. “I can’t take on any more volume with the two employees I have, can’t build the business because no one wants to do this type of work. The number of shops in the area are down by more than 33%. Demand is there—just can’t meet the volume needed.”

More than 60% of businesses responding to our survey cited their employee numbers were unchanged in 2024, with 19% each up or down. They are almost evenly split as to whether they will hire in 2025 or stay unchanged.

Future plans: Diversifying, adding products

Time moves only forward, and the Advanced Textiles Association survey also asks about businesses’ plans for the future. Top of the list this year and last year in importance was “enhancing the ability to provide customized/personalized products.” For one anonymous businessperson, the focus is presumably concentration on the core work: “I plan to make more boat tops.”

Making improvements to the supply chain has dropped off the Top 4 list this year, replaced with “public/private partnerships with government or higher education,” although that choice had the fewest responding neutral.

With tariffs potentially not only affecting U.S. importers of advanced textile products from China but also those doing business in Canada and Mexico, it will be interesting to see if “supply chain” is back on the list next year.

Diversification of products and R&D are ever important to survey respondents. Businesses plan to expand domestically, enter new markets and create new products with existing capabilities. More than one-third plan to make a capital equipment purchase.

Wholesale Shade’s Howe had some insight about diversification in relation to his company’s customers. “The companies that were way up [last year] were the ones that expanded their customer base,” he said. “The customer with the biggest gain in 2024 was in the outdoor-site furnishing business but did not offer shade products. They started adding shade products in 2023 and doubled their sales of shade in 2024. They found a void in their local market and exploited it.

“Another customer with big gains in 2024 went from only offering off-the-shelf products to adding full custom products designed specifically for the project. They reached more customers with a more profitable product and had a great year.”

He continued, “In my opinion, it’s not a question of the size or history of the business that determines success in uncertain times but whether or not the decision-makers are paying attention. Businesses that get distracted or complacent are the ones that are at the mercy of the market. Businesses that are always looking for new opportunities and voids in the market are the ones that thrive in all economies, good and bad.”

Chism noted that business concerns in the present can be directed toward actions for change and that the association can help. “To change, to discover what members are implementing to transform challenges into opportunities, consider this an open invitation to attend [Advanced Textiles] Expo,” he said. “Network with members, both fabricating and supply side, discuss concerns [and] get answers to what people have tried, what has worked and what did not work, changes in products or services where people are meeting success. Check into ATA member services and benefits—personally, our business reduced 2025 group health costs by five figures using ATA. … Put your association to work for you.”

Cathy Jones is the senior editor of Specialty Fabrics Review and she thanks everyone who took the time to fill out this year’s survey, especially those who left comments and those who were willing to be interviewed. She regrets that she couldn’t get in all of the comments.

State of the Industry webinar

Join us July 16 at 1 p.m. EDT for this year’s Advanced Textiles Association State of the Industry webinar. A panel of industry experts will discuss the results of the survey and some of today’s top issues.

Register at textiles.org/events.

ATA Member Benefit Spotlight

Savings

- Health and benefit insurance

- Business insurance

- 401k plans

- Shipping discounts

- Payment processing discounts

- Energy consulting

- ISO certification

- Travel and transportation discounts

- Supplies discounts

- Payroll services discounts

Business enrichment

- Networking

- Workforce Development Council

- Training and leadership development

- Succession planning

- and so much more!

Visit textiles.org/membership/benefits for more information.

TEXTILES.ORG

TEXTILES.ORG