Who could have predicted, even 10 years ago, that Amazon would have driven shade and awning companies, let alone everyday retail stores, into changing their operations to meet the demand

for overnight response rates? Yet today, more than we’d like to believe, sales behemoths like the online portal Amazon and similar services have taught consumers as a whole to expect quick turnaround times on purchases.

This phenomenon has invaded the marketing, sales and delivery of shade products such as drop-down screens and rolling shades, and could be one of the main influences (along with greater requests for automated controls and increased protection from the environment) in a radical, if gradual, shift in business practices for awning and shade product manufacturers.

“This trend of customers demanding rapid response, and rapid delivery, has been happening more and more over the past several years, especially over the last couple of years,” says David K. Traub, CEO of Rainier Industries Ltd., Tukwila, Wash. “I see it as sort of like the Amazon system of near instant delivery; the online, click-to-buy/rapid-delivery model that much of retail is seeing these days. But you can’t only implement a good Web strategy. The entire system must be incredibly fast and reliable for this to work.”

Market forces

Equally influential is the steady move toward integrated controls and mechanization of shade systems, right in step with general societal trends of the so-called “smart style” or Internet of Things (IoT) remake of everything. (See “Inside out,” April Review.) “Customers have more choices [today] with options as far as home automation and easy remote controls that are easier to install and wire to the building,” says Robert Martensson, president, Sunair® Awnings & Solar Screens, Jessup, Md. This steady adoption of connected, automated screens has pushed sales toward more exterior shading than in the past, certainly more than was the case even a decade ago. “The U.S. market, relatively small but growing, is in a trend toward more exterior shades, when traditionally it has been interior shading and interior roller shades,” says Martensson.

These forces may be in reaction to the fact that outdoor living spaces, which promote increased home values, are becoming more desirable in residential real estate, an outgrowth in turn of increased dining out by consumers where “al fresco” exterior dining spaces bring in premium returns. When people see how easy it is to spend time outdoors in public spaces (restaurants, hotels, night clubs), and that this is a benefit from the use of shade retractables and screens, they begin to apply this to their own residences. Over the past five to ten years, “The retractable solar screen business has grown substantially,” says Ed Keough, senior vice president of sales and marketing, Futureguard® Building Products Inc., Auburn, Maine.

“This is a combination of awareness and the measureable benefits with regard to both visual comfort and energy savings on the air-conditioning side.” And these retractables “are primarily purchased for sun protection to expand the useability of decks and patios. The retractable feature keeps maintenance to a minimum and motorization adds to ease of use.”

At Titan Screen® in Naples, Fla., Jeff Barkin is director of dealer relations, marketing and operations for Titan motorized retractable screen systems. He comments: “The two main driving factors for the purchase of Titan Screens and our other shade products are shade/comfort and protection from insects and other atmospheric conditions like sun, wind, rain and cold. Energy savings and increased home value are a great added benefit … but rarely cited as the main reason for that purchase.”

In the Midwest, Jackie Beals, president of Custom Awning Inc., Osceola, Ind., acknowledges the impact and importance of responding to climate and local weather conditions. “We do a lot of institutional canopies for clients such as nursing homes, doctors’ offices, industrial settings and a few churches and restaurants,” she says. “We have to pay close attention to structure in all the screened installations because of the wind and weather.” Osceola is just six miles from the Michigan border and only 35 miles southeast of Lake Michigan, where the “lake effects” can dump significant precipitation inland as snow or rain, backed by strong winds. “Clients ask for windbreaks (mostly clear vinyl in our case) for safety against the weather and climate,” she adds.

Market trends

A continuing movement toward digital sales, such as that found now in most retail merchandising, is only to be expected in the screens and shade products market. “Digital transformation is about moving from an obsolete product-centric model to one that is customer-centric,” says Sanford (Sandy) Stein, founder and moderator of RETAIL SPEAK™ (a LinkedIn platform that explores retail trends). This focus on the customer is proving to be the saving grace of many businesses that bolster sales by providing excellent, memorable customer service. This holds true for both direct online sales and sales that come from intermediary dealers of shade systems.

“I would say this societal urge to want rapid response, instant gratification, has certainly appeared in our operations with these shade systems over the past five to ten years,” says Traub. “As an example, one newer aspect we find is that dealers will search our online website for every bit of information they can want about the system (e.g., warranties, color options, dimensions, customization choices, etc., which they share with their customers) before placing an order. No one really wants to pick up the phone anymore, and they certainly won’t accept it as a requirement to get information.

“Then they’ll place the order and expect it immediately! It’s like their client is thinking, ‘Hmmm, we’ve got a large group of people coming over next weekend, the weather report predicts clear and sunny, and that patio could sure use some shade. Okay, I want a shade system in place in time for the party. I want it now!’ And we see it as our mission to make it happen.” Rainier’s biggest sales are retractable screens, the Rainier Screen System, which the company builds in Washington State and North Carolina. Every unit is custom built to order (based on a series of modular options) and ships in less than eight days.

Regional differences also affect the type of product that sells and gets installed, both commercially and residentially. “Sunair’s large screen segment (growing in popularity) are the zipper screens that constitute the bulk of our sales in the screen segment,” says Martensson. “Zipper screens are sold residentially for roofed overhangs and for [placing] in front of screened-in porches as extra sun protection or privacy. Commercially, zipper screens are typically sold to restaurants as winter enclosures.”

Sunair has a network of national dealers and two manufacturing plants located in Maryland and Arizona. According to Martensson, the company also finds differences on the end usage between commercial and residential customers. “The East Coast sells more zipper screens commercially due to weather (with vinyl fabrics and clear vinyl windows); southern states and the West Coast sell more zipper screens for homes (with mesh fabrics); screens in general for southern and West Coast regions have been traditionally more residential due to more sunlight exposure and the need for sun protection to homes with western exposures.”

A smarter, greener future

What’s in store for this market in terms of products for five, 10 or 20 years down the road? “The key for the shade and the screen market in the USA and Canada,” says Jeff Bedard, director of Sunesta® Awnings and Outdoor Comfort, Jacksonville, Fla., “is for more marketing and sales of what is currently available.

The majority of homeowners has never owned or considered a retractable awning or screen for their home. Our market needs to keep investing in growing the awareness of these products. The future should include the improved ability for the consumer to easily purchase these products with the assistance of a local professional. As the market grows, interest in retractable rooms will become more interesting and easier to justify for second-generation buyers of today’s products.”

“I wish I had a crystal ball,” say Keough. “But I imagine things like fabric that can capture solar energy have some promise, but probably not on a meaningful large scale,” just yet. Keough adds that a better “overall awareness of the products and their benefits in general, driven by stronger national marketing, would help to expand business at a faster pace.”

“In the U.S., the larger market has traditionally been interior shading and interior roller shades,” says Martensson. “By contrast, in Europe exterior shades are more common. I expect that U.S. customers will install more screens operated by solar-powered panels and battery backup options in the future. And the interest is there to use greener products friendly to the environment, including recyclable fabrics.”

“The next generation of Titan Screen will be rolled out this year,” says Barkin. “While we have always prided ourselves on providing an excellent product, we took a critical look at the Titan system, met with our customers, and implemented many changes they wanted to see. Another change to be implemented is the motor that we’ll use. We consulted with Somfy® on the development of a motor specifically for retractable screens, which will become our standard-use motor in the very near future. We are continually adding new markets domestically, and in the Caribbean and Canada. And, at some point in the future, we anticipate adding a louvered pergola to our local and national product line. In short, our markets will continue to grow through new dealer acquisition and new product development.”

“I see the increasing integration of our screen systems with the ‘smart home’ movement,” says Traub. “For instance, Rainier has an agreement with Somfy to use their motors that can be synchronized with home control systems—the IoT trend that many home builders and home owners are adopting. Personally I think it rather silly to have a ‘smart refrigerator,’ but more and more homes are coming equipped with smart, integrated controls.

“Another future trend I see that is more satisfying is the growth of environmental consciousness. Rainier is and has been ahead of this trend for some time now, and we recently recertified ISO 14001. People are demanding that manufacturers, builders and suppliers are not using toxic or hazardous materials or procedures in their operations: that products are not contributing to waste generation or are harmful to the earth. We are a green company because this is more and more important to our customers,” says Traub.

While the general trend is toward greater acceptance by the public, growth of the retractable shades and screens market in the U.S. and Canada has been steady but could be much greater. A more concerted effort by the industry to educate potential clients would help significantly, and the marketing must take into account changing consumer buying habits, such as online research and purchasing.

Bruce N. Wright, AIA, is an architect, teacher, consultant to architects and designers and a frequent contributor to Specialty Fabrics Review, Fabric Architecture and Advanced Textiles Source.

When it comes to shade, there are differences on how best to apply it to buildings, depending on where you’re located. And the difference between the European approach and that of North America is a case in point. To learn more about these differences, I spoke with Cristian Biondi, director of sales at BAT USA, a subsidiary of the BAT Group S.p.A., Noventa di Piave, Italy. The company has sales and fabrication facilities in France, Spain and Dubai.

Bruce Wright (BW): What products do you make within the screen and shade sectors, and where do you sell them?

Cristian Biondi (CB): BAT USA is part of the BAT Group, a world market leader in the industry of accessories for awning systems for more than 30 years. BAT manufactures cassette awnings, folding arm awnings, screens, canopies and custom products as well. We supply components to clients representing lots of manufacturers to clients, such as contractors or construction companies, across the U.S. And these clients are in turn selling to both residential and commercial clients.

BW: What benefits matter most to your customers?

CB: I would like my clients to be nobler [in their understanding of the benefits of shade and screen systems], and they are to a large degree, but their clients are not. That is the biggest difference between the United States and Europe. Europeans, and others elsewhere around the world, are very aware of the benefits [of shading devices]. Consumers in the States are not yet focused on energy savings and benefits to health from shading systems.

Visual comfort is a basic parameter of living comfort: BAT is well aware of this, and thanks to our Screeny system, which is perfect for the external shading of windows and curtain walls, it meets the canons of “daylighting”—the culture of designing architecture opened to light and attentive to the surfaces’ materials, while maximizing the visual comfort and reducing energy consumption.

BW: What do you see as the future of these screen and shade products in the next dozen years or so?

CB: There are a lot of new products in Europe on the market. The U.S. doesn’t consider this because most shade products are purchased by homeowners through home building supply stores and lumberyards; in Europe, the market distribution is different, as shading systems are tailor-made, and often buildings have stricter requirements.

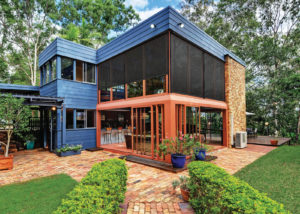

Solar shades for the European market are more focused on high-end design and materials, while in the U.S. the styles have not really evolved to the same level yet. The most that might be found in U.S. markets are pergolas with drop-down screens, because American homes tend to have much more room around their houses where these pergolas can be placed.

My hope is that American attitudes will change as more and more people become aware of the savings in energy and increases in comfort they can get in their homes by using screens and shading devices.

—B.W.

With consumers wanting more sun control and energy efficiencies, the trend toward use of screens has shifted away from more open meshes (5 to 10 percent open) to less openness (3 to 5 percent), says Robert Martensson, president of Sunair® Awnings & Solar Screens, Jessup, Md. “Screens over the last five years have trended towards more closed meshes, and zipper screens (where the fabric retention is held tight within tracks) are attractive to dealers and consumers alike because these systems are not exposed to wind issues.”

Jackie Beals, president of Custom Awning Inc., Osceola, Ind., says roll-down screens are most often fitted with FR PVC meshes or solid PVC for both commercial uses and screened residential porches at lakes (and the occasional industrial setting), but woven acrylics are reserved for most

other residential applications.

What is the best combination for installation? According to Martensson, it depends on whether the system is a roll-down or zip frame; and to ensure a visually pleasing result, you should pay attention to the weave of the fabric as well.

“If you install a roll-down screen on an existing screened-in porch, the roll-down mesh you choose must be a twill weave so as not to cause a moiré effect. The moiré effect is caused when two basket-weave mesh fabrics are placed in front of each other, causing a dizzying feeling when you look through both. The twill weave will stop this from happening.”

For additional sun control, Martensson finds that zipper screens may be added to a screened-in porch (with existing mesh fabric screening), as such bug screening is usually inefficient at controlling sunlight and glare.

TEXTILES.ORG

TEXTILES.ORG