By Elisa Bernick, Sammi Jones, Jill C. Lafferty, Galynn Nordstrom, Rebecca J. Post and Janet Preus

The global response to the COVID-19 pandemic is unprecedented, with the textile industry playing a key role. Suppliers and end product manufacturers have pivoted at lightning speed to produce much-needed PPE for front-line medical workers. IFAI members are reaching across markets, sharing designs and resources, and offering ideas and support, all while taking actions that reflect a high concern for the health and safety of the textile workforce. Indeed, the first step for many companies either deemed “essential” by authorities or not under “shelter in place” rules was to reorganize to maintain safe operating conditions for employees, as well as customers.

Among the many IFAI initiatives (see page 25) that came together in this historic moment, the organization conducted market-centered webinars asking members what steps they’re taking, what issues they feel are paramount, and what they anticipate in the next few months. “The member forums provide an atmosphere for sharing during a time of confusion,” says Christine Gerard, division operation manager at IFAI. “This is a way for members to give back to one another.” In the weeks and months ahead, IFAI will continue to sponsor timely webinars and trainings to help industry professionals respond to COVID-19.

As this issue of Specialty Fabrics Review goes to press, many unknowns remain. But as industry companies juggle issues like the need to protect employees, the need to protect their businesses, and the critical need to supply health-care workers with protective gear, we can take comfort in at least one known: We’re all in this together.

Advanced textiles: The urgent call for PPE

The rapid spread of the coronavirus was accompanied by an urgent call for personal protective equipment (PPE), particularly masks. There were plenty of manufacturers who wanted to join the effort to provide PPE, but they had never made these products before. Cut-and-sew operations, closed as “nonessential” businesses, were willing to reopen and use their facilities, workers and expertise, but they also needed to get up to speed on government specs, sourcing materials and patterning to make a product that would work.

Connie Huffa, principal, Fabdesigns Inc., Agoura Hills, Calif., explained during an IPC virtual meeting that there are a lot of risks associated with manufacturing medical products, as opposed to fashion. With four classes of masks, all designed to perform in specific circumstances, the specifications for each are different.

However, in an effort to move quickly, small operations used what materials they had on hand. With nonwovens in short supply, wovens and knits offered “something rather than nothing” for protection.

Stephanie Rogers, director of product research and development at Apex Mills, Inwood, N.Y., told meeting participants, “The woven world is coming in second,” but that will “dry up,” too. Essentially, entangled fibers of almost any kind could be used, in theory, to make fabrics for masks, including wool and other natural fibers.

The critical N95 masks (see page 55), however, that are made of spunbond nonwoven layers, also have a meltblown nonwoven layer in the middle, and therein lies one of the challenges. Meltblown materials take longer to manufacture, so even if other nonwovens were available, the production of N95 masks was stalled.

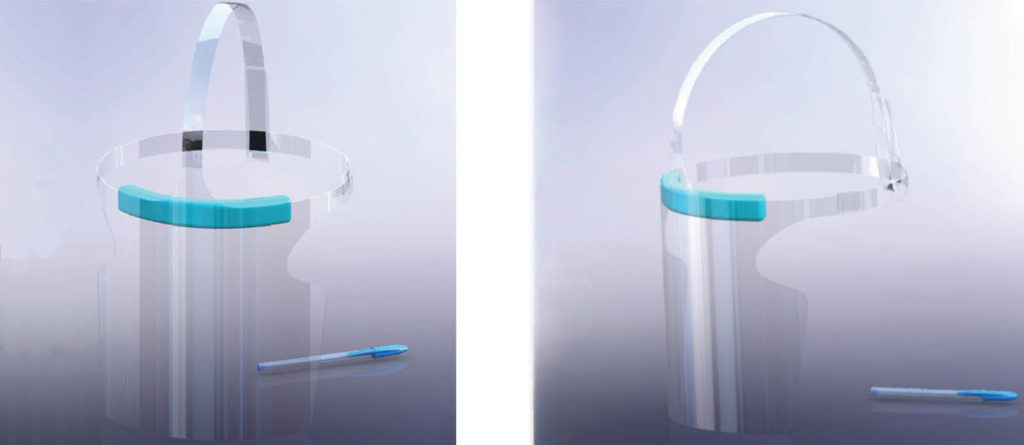

Masks aren’t the only PPE in short supply. Health-care workers who treat COVID-19 patients also need goggles, a face shield, gowns and booties. And other hospital employees require protection too, although PPE alternatives can be given to them, while reserving the most critical PPE, such as the N95 masks, for the workers providing direct care.

There’s also the question of fabric treatments. Rogers said medical textiles, including scrubs, generally need barrier protection to prevent fluid transfer. “A DWR [durable water repellent] can address this,” and an antimicrobial can also be added, but that can weaken the effectiveness of other treatments.

“If you have to pick between DWR or antimicrobial, pick the DWR,” Huffa said. Masks not meeting FDA specs could be used as over-masks to make the N95 last longer.

Rogers cautioned that antimicrobials don’t stop viruses. “It’s really the reduction of particle movement and the prevention of reaching another person,” she said, which can be accomplished with many kinds of fibers.

Chris Semonelli, vice president/sales manager for Erez USA Inc., Newport, R.I., and chair of IFAI’s Advanced Textile Products division, says that to expedite the process and get end products where they need to go, there needs to be “clear specifications and quantities, and reasonable delivery time frames. But there also needs to be some flexibility with technical textile specifications, “keeping in mind the finished product’s function,” he said.

Semonelli says industry participants have risen to the challenge. “I have never seen a period where people in our industry want to help so much,” he says.

Paige Mullis, director of concept development with Glen Raven Inc., Glen Raven, N.C., adds, “Things we’re putting in place today as reactive, might become the way we operate day-to-day.”

Makers, marine, military and more: Can we pivot?

Suppliers and end product manufacturers in several other IFAI divisions spent the earlier weeks of the crisis reorganizing to comply with federal and state regulations for businesses still in operation and exploring the possibilities of devoting their resources into making PPE, medical kits and industrial curtains.

“The industry is trying to work collaboratively and cooperatively—with each other and with industry organizations. We need a living supply chain,” Frank Henderson, CEO of Henderson Sewing Machine Co., Andalusia, Ala., said in one IFAI webinar.

Jeff Newkirk, MFC, owner of Precision Custom Canvas Inc., St. Catharines, Ontario, Canada, pivoted his marine shop to produce nonmedical-grade face masks, face shields and barrier curtains aimed at secondary markets such as pharmacies, grocery stores and nursing homes.

Newkirk says that like many in the marine industry, he jumped on this opportunity to help his community, to keep his employees working and to keep his shop afloat. “Let’s face it, the economy has tanked and we work on people’s toys,” he says. “The phone is not ringing for new jobs. We see a lean summer going into fall. I see this opportunity to make PPE as a community service and also as an opportunity to produce income. We’re being ethical by charging a fair margin, and it will enable us to weather the upcoming economic storm.”

When marinas and nonessential businesses were shut down in Michigan, Rob Kotowski, Lake Shore Boat Top Co., St. Clair Shores, had no choice but to lay off 12 employees. “Worst day of my life. These people are like family to me,” he says. Kotowski’s shop was awarded a state contract to produce medical safety shields and surgical masks and is doing mass production cutting for other companies producing PPE. “With our state contract, we have five employees working right now, and we are hoping each day to be able to bring more back.”

Michael Woody, CEO of Trans-Tex LLC, Cranston, R.I., and immediate past chair of the Narrow Fabrics Institute, says many manufacturers who have pivoted to PPE production are frustrated by the lack of coordination among state officials.

“We manufacturers want to help, but we feel like airplanes flying over the airport ready to land and there’s no one in the control tower telling us which runway to use or which bay to pull into.”

Woody, whose narrow web printing company is ramping up PPE production, says manufacturers are used to pulling the trigger and getting production going, but given the onslaught of conflicting information and a maze of different state requirements, it’s hard to find a central clearinghouse that connects fabricators, suppliers, raw materials and buyers, or a clear path about where to send needed PPE products.

Trying to connect the different parts of the supply chain—and getting a normally reliable supply chain to move—is one of the biggest challenges right now.

Before the crisis, fastening supplier American Plastics, Tracy, Calif., was well stocked with elastic, according to president Gary Grewal. By the end of March, that supply was depleted due to demand for elastic in face mask production, and the company was working with an overseas supplier to restock. “[The overseas company is] under a lockdown and not even allowed to go to the factories anymore,” he said in late March. “They had about 200,000 yards of elastic on their floor, and I said we need that elastic here. They had to get special permission from the police, with a police escort. They took that freight to the airport, and it landed in Los Angeles. Now we just have to clear customs and then bring it over to our warehouse, but it was a nightmare trying to get it on the aircraft.”

But even as end product manufacturers see the production of medical products as both a noble activity and a lifeline for their business, it’s not without risks, in particular, being stuck with materials and inventory when demand drops. Ron Houle, founder and president of Pivot Step Consultants LLC, Burke, Va., is advising fabricators who produce medical gowns. He says companies need to do a risk analysis when pivoting to PPE production to determine if they will sell enough to make the ramp-up worthwhile.

“It’s less about duration of this response and more about small companies breaking through the noise next to companies like 3M who are tooling up to produce millions of these products.”

What’s next?

Not all textile businesses are feeling a slowdown. Charlene Clark, co-owner of Signature CanvasMakers in Hampton, Va., says while they are producing some PPE products, they are still conducting marine business in a relatively normal fashion while ensuring that employees remain safe.

“But we are certainly concerned about the long-term implications of this pandemic and are taking steps to ensure that we will be able to keep our business operating and liquid,” she says. This includes making cuts to reduced overall expenses and working with the bank and taking advantage of local, state and national resources available to small businesses.

Kevin Sandefur, production manager at Awning Works Inc. in Clearwater, Fla., takes the perspective that businesses that have survived for decades do so because of their ability to adapt and overcome.

“The people that are strong, engaged and teachable will adapt and survive. Business will return; it will be profitable but it will be different—we better make it different,” he says. “I foresee personal hygiene SOPs, environment processes and personnel guidelines changing for the better.”

An issue on the minds of many manufacturers are the larger lessons to be learned from the pandemic—especially about how to make domestic PPE supply chains, critical health care needs and the pharmaceuticals pipeline more reliable and less dependent on foreign suppliers.

Jonathan Palmer, CEO of cutting equipment supplier Autometrix Inc., says that once people have a sense of confidence that COVID-19 is under control, we’ll start to see how quickly consumer spending bounces back and if government programs to sustain it have worked. “I do think that there’s going to be a lot of new energy in the conversation about keeping manufacturing local—whether that’s local to us here in the U.S, or local to our customers in Europe, Asia, wherever,” he says. “Everyone’s been exposed to how fragile a global ‘just in time’ supply chain can really be.”

SIDEBAR: IFAI responds to COVID-19

IFAI’s response to COVID-19 has taken on many forms of communication—all with the intent to help textile professionals mobilize in a time when manufacturing PPE has been more important than ever.

COVID-19 Supplier Directory. IFAI along with the National Council of Textile Organizations (NCTO) and Association of the Nonwoven Fabrics Industry (INDA) created a COVID-19 Production Capacity Database. The database includes finished goods and input information on PPE. Visit www.ifai.com/covid-19/supplier-directory.

IFAI’s COVID-19 Resource Center. This website is a hub that aggregates a variety of information, including government news, financial resources and companies’ offerings for products, services and equipment. Educational trainings are posted along with sourcing requests and opportunities. Visit www.ifai.com/COVID-19.

Webinars. Webinars were hosted by IFAI for all of the market divisions mid-March through early April. The webinars gave members a chance to share observations on pivoting their businesses, keeping employees safe and working remotely. More webinars and trainings are planned.

Member emails. IFAI is sending regular electronic updates to members on many pertinent topics, including overview explanations on the COVID-19 funding from the federal and state governments.

Social media. Regular Facebook, Twitter and LinkedIn posts are shared on what companies are doing to fortify health-care workers and consumers with PPE equipment and other protective gear. The posts capture the energy and commitment of an industry that is making a difference in preventing the spread of COVID-19 infections.

SIDEBAR: Tents: “Survival is success”

Perhaps no other IFAI market took on more immediate damage than members of the Tent Rental Division (TRD). Tent rental companies that were gearing up for a robust spring season, and those whose season was already underway, spent the month of March scrambling to adjust as the pandemic forced cancellations and postponements of all types of tented events. Face masks joined hard hats and safety vests as required PPE on tent installation sites as companies pivoted from weddings and festivals to temporary hospitals and drive-through testing shelters.

As cancellations mounted, one of the biggest struggles rental businesses faced was the decision to lay off employees. In a video conference for company owners hosted by tent washing machine manufacturer Teeco Solutions in mid-March, one owner related the pain of telling employees that they were out of a job, while others said they were putting off that step, even though it was costing them money.

“To me, that’s where the rubber meets the road,” says Teeco’s Steve Arendt, CEO and founder of the Kirkwood, Mo.-based company. “That was a heartfelt moment.”

In a video conference focusing on cash strategies hosted by Pennsylvania-based tent installation tool supplier Tent OX, rental business consultant Gary Stansberry of the Stansberry Firm LLC, Fair Oaks Ranch, Texas, said that in 2020, “survival is success” for tent rental companies.

Video conferences are just one way that competitors joined together. Rental companies have shared photos of hospital installations and CAD diagrams of drive-throughs to help other companies advertise their capabilities. New industry Facebook groups popped up. Ten U.S. tent and structure manufacturers banded together to connect customers with official emergency channels such as the Office of the Vice President and Republican and Democratic governors’ associations.

For tent rental companies that were able to land contracts to install tents for medical testing sites, an issue when the crisis is over will be how to properly clean the vinyl and frames, says Michael Tharpe, national sales manager for Rainier Tent and TRD steering committee chair. “Can I put it back in my rental fleet or do I have to destroy it?” he says. “What is the cleaning process? How do I make it safe for my own employees and customers if I want to rent it again?”

With some tent rental companies closing at least temporarily, the balance of supply and demand when the crisis is over will pose another challenge, Tharpe says. Companies are looking closely at federal economic relief options and their workforce.

“Tent rental people are going to look at their employees, how much they contribute to them, how valuable they are to the company, and they are going to make wise use of the money they have available before they make investments in anything.”

Tharpe expects that lessons from this moment will change the way tent renters and manufacturers do business. The best-case scenario for the industry will be that, when the crisis is over, the general public will want to come together in groups more than ever.

“People will realize we’ve been through something that we have never seen before,” he says. “How do we celebrate this? Should we gather together and just mix with one another, renew friendships, renew contacts, making this a positive achievement? We came through this! Let’s celebrate! Let’s do things differently so that we don’t have to go through this again.”

TEXTILES.ORG

TEXTILES.ORG