Each year, Advanced Textiles Association (ATA) surveys the readers of all of its publications, members and nonmembers both, to take the pulse of the current state of our industry. The survey asks questions on business sizes, revenue projections and recent sales context, top concerns, future plans, and a bit about the many different markets that our industry enterprises serve, from aerospace to upholstery and everything in between.

More than 120 respondents took the survey this spring, representing a variety of markets; the largest segments were end-product manufacturers at 34%, suppliers at more than 16%, engineering/architecture/design firms at 12% and marine fabricators at almost 10%.

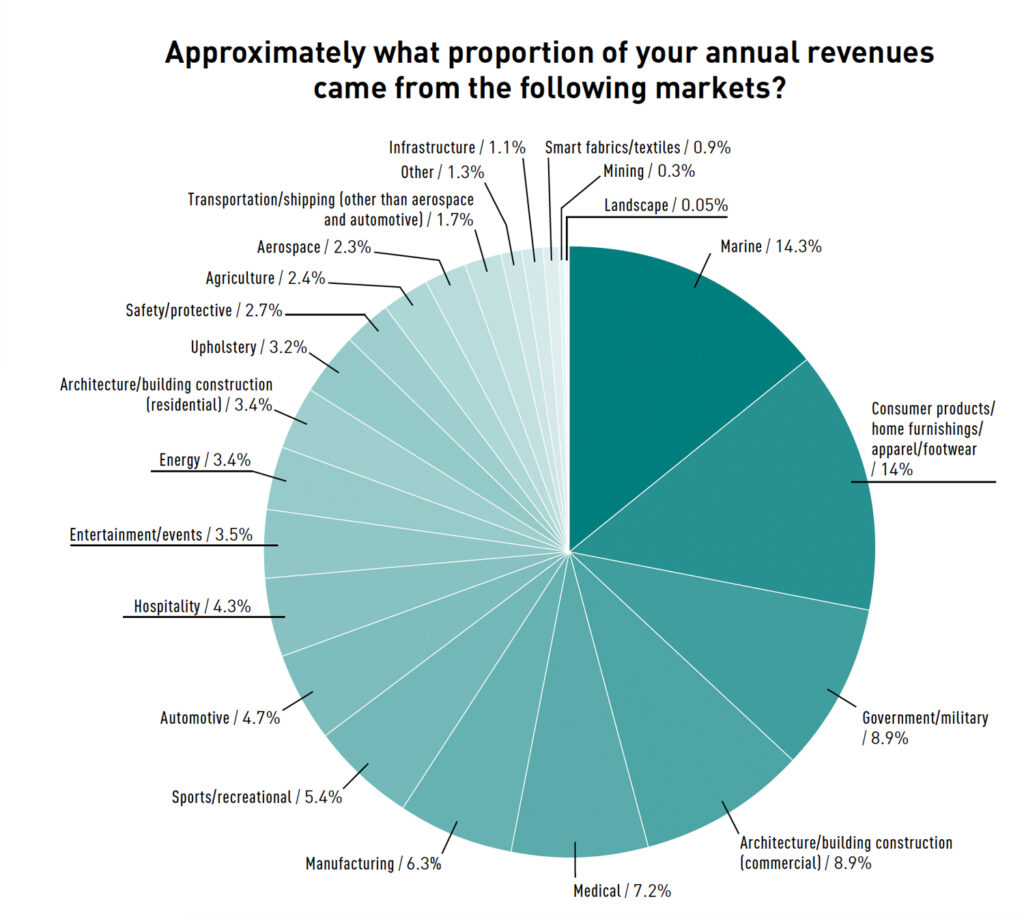

The companies were involved in a wide variety of markets; the highest proportion of revenues from survey takers were marine (14%) and consumer products/home furnishings/apparel/footwear (14%). Sales happen around the world, but businesses derive the majority of their revenues from North America.

Survey takers ran the gamut of firm sizes, from those with revenues of less than $500,000 to $10 million or more. Almost two-thirds of the responding companies have fewer than 50 employees, with 20% having four or fewer employees. Half of the companies who listed their employee size said that their staffing level was unchanged since last year. Businesses with an increase or decrease in employee numbers almost equally split the other half, with 26% up and 24% down. By how much up or down wasn’t asked; however, 47% planned to hire, and fewer than 3% said they did not. Thirty-seven percent planned to hold employee numbers steady this year.

Demographically, the ages of those employed at respondents’ companies are right in the middle, with approximately 44% being 35–54-year-olds. Millennials, roughly in their 30s and early 40s, are now the largest U.S. age demographic. The age groups at the high and low ends of the employee-age bell curve may illustrate a perennial concern for our industry: The proportion of those working at these businesses 65 and older, at 14%, is double those younger than 25, which is at 7%. To be fair, many people aged 18–24 are in postsecondary schooling rather than in the workforce, or they could be a part of the gig economy rather than holding a regular job while they’re still able to be on their parents’ health insurance. As a portion of the population, the younger set comprises more than 9% of the U.S. and those ages 65–71 come in at roughly 8%.

Revenues, prices somewhat up

Each year we ask about revenues from the previous year. Revenue reports between the survey this year and last (see charts at right) differ the most at the top and bottom sections of the data, with 29% reporting 2023 revenues up more than 10%, which is more in line with the 2022 survey’s reported figures than 2023’s 42%. A little more than 17% of businesses reported that their revenues were down more than 10% in 2023, compared to only 7% reporting that same level of decrease in last year’s responses about 2022. We can’t conclude from the data collected whether these were among businesses that had a big spike last year and were just coming back to a more normal operating level. In a more positive finding, only 13% of respondents expect their 2024 revenues to be down, with 59% projecting revenues upward.

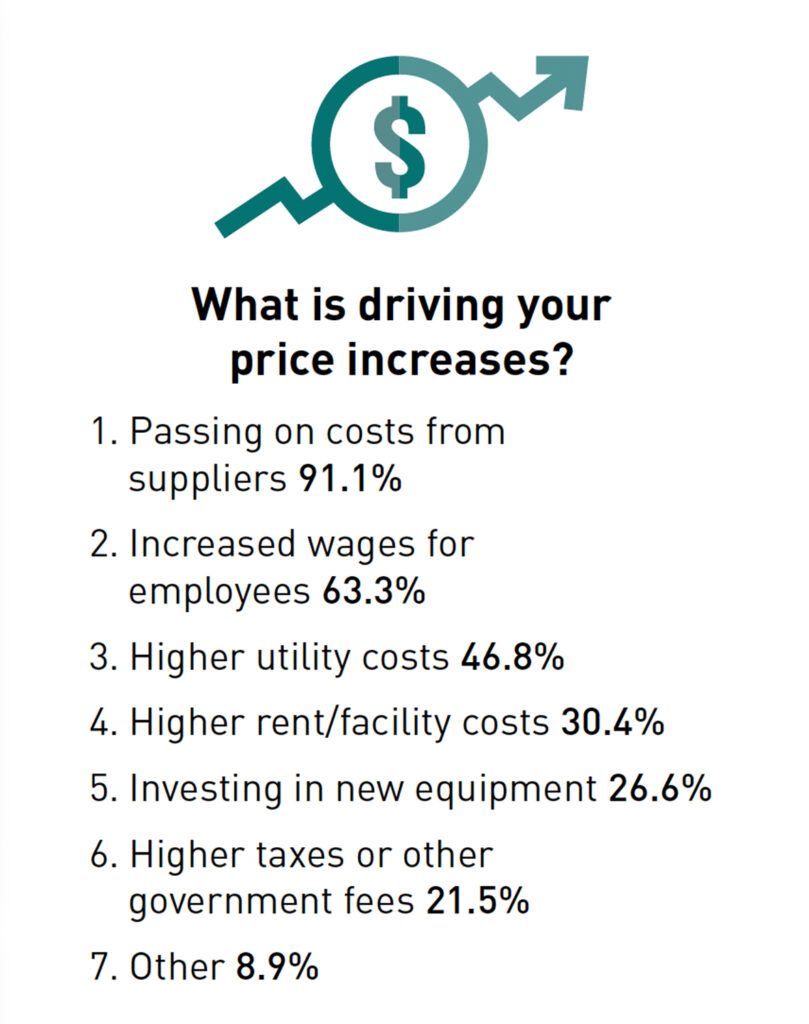

In last year’s survey, the price increases (see charts on 23) reported from respondents’ suppliers were much more dramatic than the 2024 survey, up 10%–25% or more for 63% of businesses; in this year’s responses, the companies paying 10% or more amounted to less than half of them, at 41%.

Price increases that textile companies are passing on to their customers are mirroring the overall economic inflation direction taken by the consumer price index (CPI): Companies raised prices in 2023, but not nearly as dramatically as the previous year’s hikes. Other big drivers of price hikes are increased wages and higher utility costs. The percentage of businesses reporting in this year’s survey as raising prices 10% or less was 43%, compared with last year’s figure of 58% raising prices by at least 10%.

For inflationary context, last year at the time of our survey, the CPI in the United States was running at 5%, according to Statista; this year, it was 3.5%, which is at least near the average of 3.3% from 1980–2023. (By comparison, for ATA’s industry survey done in March 2022, the CPI was 8.5%.) Though the 2024 CPI is better than a year ago, it’s not at the 2% that the Federal Reserve targets for max employment and price stability. The more recent average from 2012–2021 is 1.9%. Although the CPI measurement doesn’t comprise exactly the same goods as would be in companies’ business-to-business transactions, it’s still a widely reported measurement of the overall U.S. economy with a lot of historical data for comparison. Fortunately, economists’ concerns about a recession didn’t come to fruition in 2023.

Top concerns

Our survey listed 21 potential concerns for respondents to rate in terms of importance, ranging from wars to imports and from cash flow to PFAS. Those concerns at the top of the heap, voted as a 4 or 5, were about the same as previous years, just in a slightly different order and mostly relating in some way or another to costs, prices and margins. This makes sense, as it’s the bottom line that keeps a company operating. It was a photo finish, but inflation worries were big enough to put that category slightly ahead of finding skilled labor, 2023’s top concern.

Utility costs edged supply chain delays out of the top 6 in this year’s industry survey. ATA received these survey results the day before the Baltimore bridge collapsed, but that may not have changed the participants’ responses, as businesses have been adding redundancies to their supply chains and nearshoring what they can post-pandemic. News reports following the collapse mostly focused on the vehicles and farm machinery that go through Baltimore when speaking of long- and short-term supply chain ripple effects, but as an important logistics port for the East Coast, there may be some temporary impact, especially for people local to that area. By the time we survey our businesses again next spring, supply chain disruptions from that bridge collapse probably will have been worked through.

Besides looking at the top vote-getters to see trends, it’s always interesting to look at additional details that people provide, either expanding on their answer or giving their unique concerns. One person specified customer “inertia.” Another explained, “Clients are fearful to spend due to the instability in our country.” However, slowdowns are cyclical for one business: “Our business sees a drop any election year,” the respondent said.

In the workforce category, respondents were concerned about what one termed as “knowledge retention.” One got more specific about a demographics issue: “Replacing an aging workforce with qualified personnel.” Another was concerned about the lack of people to put into apprenticeship programs to fill that workforce pipeline.

Other common concerns cited costs of taxes, insurance and regulations, with California regulations called out specifically by one business, and “changes to building code requiring additional bracing, increasing costs.”

Competition in niche markets driving prices up and competition by cheaper online goods were felt by other respondents, as well as the rising cost of imports and a need for domestic suppliers. Some businesses also would like to find suppliers that allow for smaller minimum orders.

“Keeping up” was a concern several businesses expressed. Responses included keeping up with business, tech and computer advances, social media and digital marketing, and the trend toward sustainability—and even keeping up with work in general.

Looking to the future

Growth and diversification—even retirement—takes planning. As businesses look to the next two years, 52% aim to enter new markets, 51% plan to purchase equipment, 26% plan to rent or purchase automation equipment, and 40% intend to develop new product lines with their current capabilities. Projections include 38% of businesses expanding domestically and 26% globally. Companies’ leaders also plan to grow their businesses through acquisition or involve a new facility, with these responses tied at 21%.

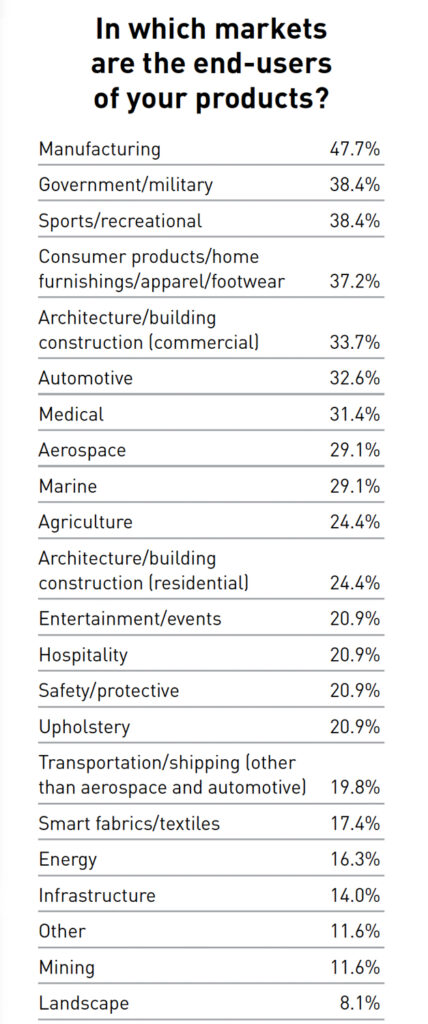

People listed many market areas as poised for growth for the overall textiles industry. The highest ranking included government/military (27%); consumer products/home furnishings/apparel/footwear (25%); medical (24%); energy (22%); and aerospace, safety/protective and smart fabrics/textiles, each at 20%. When asked about market segments where people expect a slowdown or decline in the next two years, the largest percentage of answers, 25%, indicated “none of the above” as losers, although some responses indicated automotive, consumer products/home furnishings/apparel/footwear, and entertainment/events.

There was much agreement about the most important strategic initiatives. Ranked as extremely important or somewhat important were providing customized products (74%), improving supply chain/logistics (70%), research and development (68%), and product diversification (66%). Employee-development programs came in as important to more than half, at 59%.

Where people had the most mixed responses (highest in “neither important nor unimportant” but also almost the same percentages as “somewhat important,” in the 30%–37% range each) were the use of artificial intelligence and other technology tools as well as increasing product/corporate sustainability. However, these parts of the industry still are nascent, so businesses may be in “wait and see” mode, as early adoption and being out front in a major industry shift can be expensive. It will be interesting to see whether these numbers change as the technology and best practices shake out in these areas over the coming years.

Cathy Jones is the senior editor of Specialty Fabrics Review and she thanks everyone who took the time to fill out this year’s survey. She can be reached at cathy.jones@textiles.org.

TEXTILES.ORG

TEXTILES.ORG