As the interest in and use of digital textile printing expands, wide-format printers have become essential players, opening up new and profitable opportunities for specialty fabricators.

Wide-format digital printing is expanding exponentially, spurred by advancements in printer, ink and fabric technology. Deployed for all manner of products—apparel, décor, banners, murals, signage, upholstery, wallpaper, vehicle wraps and more—the new technologies are allowing specialty fabricators to find new markets, or new places in old markets, and add some welcome revenue to the bottom line.

What is wide-format? As Lily Hunter, product manager of textiles and consumables for Roland DGA Corp. explains, the description has to do with the width and size of the printers and generally applies to those from 30 inches up to 64 inches. Wider than 64 inches is generally referred to as grand format, used for large-scale projects like billboards, theater backdrops and other super-sized projects.

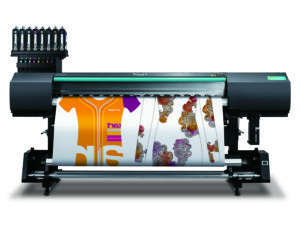

Located in Irvine, Calif., Roland DGA is the U.S.-based marketing, distribution and sales arm of Roland DG Corp., based in Hamamatsu, Japan. Roland DG provides, among other products, dye-sublimation, UV and eco-solvent wide- and large-format inkjet printers to the durable graphics market. The company’s biggest end users are sign and graphics manufacturers and some apparel manufacturers.

The application determines which fabrics are used. For example, a method becoming increasingly popular for apparel is dye-sublimation, frequently used by manufacturers providing uniform, sports and workout apparel, swimwear and more, says Hunter. Roland offers the Texart™ XT-640 High-Volume Dye-Sublimation Printer, designed for long print runs and nonstop production of products such as high-volume sportswear and fashion, soft signage and promotional merchandise. Another model, the Texart RT-640, is recommended for those wanting to get into dye-sublimation soft signage, apparel, décor, promotional goods and other applications.

“But the fabric has to be polyester/polyester-coated, and the higher the polyester content, the more vibrant the colors,” says Hunter. “It won’t work on cotton because the colors won’t stick.”

Dye-sublimation

Dye-sublimation is one of two primary methods for digital printing (direct printing is the other), says Ryosuke Nakayama, manager of textile and apparel business development and marketing for Mimaki™ USA. Located in Suwanee, Ga., the company engineers and manufactures digital printers and cutters. End users include the sign and graphics, textile and apparel and industrial markets.

“The transfer process involves dye-sublimation inks printing to a transfer paper, which is then transferred to the fabric using a heat press,” Nakayama explains. “Dye-sublimation yields vibrant colors with lower exterior longevity but increased washability.”

Mimaki offers a number of different models, from entry-level—such as the TS30-1300, “Best suited to just-as-needed production of apparel prototypes and custom goods, or as an in-studio, on-demand printer for sample production,” says Nakayama—to more high-production, feature-rich models like the TS300P-1800 or the super-wide, production-level TS500P-3200.

Dye-sublimation is also becoming more prevalent for trade show displays, promotional signage and specialty applications, says Brian Phipps, president of Mutoh America Inc.

Located in Phoenix, Ariz., the company manufactures wide- and grand-format printers for dye-sublimation and direct-to-textile applications for the consumer and industrial markets. The company’s dye-sublimation printers include the RJ-900X, specifically designed for the architectural, engineering, construction, mechanical design and Geographic Information Systems (GIS) applications; and the Mutoh ValueJet 1638WX, created for everyday printing for promotional items, banners, trade show graphics, custom interior design and similar applications.

Although dye-sublimation is restricted to polyester, says Phipps, this isn’t necessarily limiting. “Newer polyester fabrics wick for sporting applications and have the ‘hand’ and feel that works for fashion and provides durability for home furnishings,” he says. Soft signage is also being printed using this method, according to Hunter.

Direct printing

Phipps is seeing growth for small wide-format printers and grand format. “As far as size, 1.9-meter printers are becoming popular for some fabric applications depending on geography,” he says. “This size allows for 36-inch scarves at two-up, shower curtains, blankets and tablecloths, for example. While most of this is dye-sub, there’s more and more interest in direct printing.”

Using direct printing, the image is actually printed on the fabric, rather than transferred, as in the case of dye-sublimation. There are some inks and polyesters that allow for dye-sublimation direct printing, with fabric processed at sublimation temperatures.

Cotton is the most commonly used textile for direct-printed fashions and home furnishings, says Phipps, although silks and other natural fabrics are also direct printed (“Direct printing using pigments for natural fabrics is the most effective method for entry into the fashion, home furnishings and specialty markets,” he says). For this purpose, Mutoh provides the 75-inch-wide ValueJet 1938TX direct-to-textile printer, enabling users to create customized fashion apparel, upholstery, soft signage, scarves, tradeshow graphics and many other products.

Mimaki’s Nakayama says different inks are used in this method, with the specific application determining the ink used. For example, for the company’s TX line of direct-to-textile printers, there are numerous inks available such as a dye-sublimation for direct printing; a reactive dye, used on cotton, hemp, rayon, cupro, Tencel® and silk; an acid dye for silk, wool and nylon; a disperse dye for pretreated polyester and pretreated nylon; and a textile pigment, primarily for cotton (applications have differing requirements).

One of the printers in this line, the TX300P-1800, can use five types of textile-specific inks that can be directed to a variety of natural and synthetic fabrics, says Nakayama. “This printer is suitable for creating samples, one-offs or individualized production runs that include custom fashions, runway designed and quick-response orders.”

HP Inc., a Palo Alto, Calif.-based provider of personal computing and printing solutions, offers a variety of direct-to-textile latex printers (along with UV and aqueous solutions) in wide- and grand-format models serving the signage, décor, photography, fine art and technical drawing communities, says Tom Wittenberg, market segment manager of Sign & Décor for the Americas.

The latex printers can print on natural fibers and polyester, says Wittenberg, adding that if manufacturers are going to use a natural fabric for soft signage or some other type of decoration, the company prefers they use a “certified media” to ensure the substrate meets HP standards for printing, color and application (HP offers a Media Solutions Locator on its website).

Two HP wide-format latex printers are the 365 and the 570. The 365 is appropriate for small, medium and large print operations, says Wittenberg, explaining that for small shops this printer might be the workhorse; for larger ones, it could be used for short runs or proofing. The 570 has many of the same characteristics but comes with a larger print cartridge (3-liter versus 775-ml) and greater speed. The HP Latex 3500 grand-format printer is designed for high-volume, heavy-duty production, such as running multiple shifts. It works with the same media as the 365 and 570 but is almost double their width, can accommodate larger rolls and comes with a 10-liter ink cartridge.

Another direct-print technology is UV-curable printers. As Hunter explains, these printers have UV light built into them and are used for décor, specialty graphics and soft signage, rather than apparel.

“They can work with a variety of fabrics since you’re mainly printing on the surface, but usually stiffer fabrics work better,” she says. “It can be coated or uncoated, although with UV, you don’t need coated, but if this is all you have, you can use it.” (Roland’s VersaUV LEJ-640 Hybrid/Flatbed Printer can print on roll or flat materials up to a half-inch thick, and can accommodate large rolls up to 88 pounds and sheets up to 48 inches by 96 inches. The printer uses ECO-UV ink and is designed to work with the kinds of materials used in signs and specialty graphics.)

According to Michael Maxwell, senior manager of sign graphics business development and marketing for Mimaki, UV-curable printers work well for wallpaper, canvas and heavy-stock applications. The company’s super-wide, roll-based UV-LED model, the UJV55-320, includes an LED light panel for checking backlit signage during printing. The printer is recommended for manufacturing soft signage and backlit signs, says Maxwell. Mimaki also offers LUS-120 inks for this model, formulated for scratch resistance and flexibility for soft signage applications.

Mutoh also provides a UV-LED model, the production-based ValueJet 1638UH 64-inch hybrid printer. It comes with a staggered, dual-print head design and dual UV lamps, for fast cure times and higher speeds, says Phipps. “Because it’s a hybrid, it can print on rigid substrates and on roll media as well,” he says, adding that the ink options make this model excellent for printing packaging prototypes, POP displays and indoor signage.

What’s hot?

Wittenberg notices the marketplace shifting from rigid or flexible signage to soft signage with textiles, inspired by this format’s lower transportation costs, ease of use and installation and reduced storage space requirements. Maxwell says that for the exhibition, POP/POS and hospitality industries, digital textile printing has continued to advance.

“All expectations point to sustained growth,” he says, citing industry research figures indicating the global market for digital textile printing will double in value over the next five years. “This transition to soft signage could be clearly seen at the recent SGIA show, where the vast majority of overhead signage used fabric as the substrate. Additionally, stretch-frame fabric lightboxes are gaining popularity.”

Wide- and grand-format printers are right in the thick of it. Elissa Decker, senior manager of materials for Moss Inc., a Chicago-based solutions provider in tension fabric, wide-format graphics and specialty signage, says she’s seeing wide-format graphics in every market—from retail to sports—as well as at trade shows. In fact, people have become pretty accustomed to this format, she says.

“Our customers always want seamless graphics,” Decker explains. “This is especially critical for illuminated graphics for lightbox applications.”

There are other trends for printer manufacturers, such as sustainability and eco-friendliness. According to Wittenberg, HP is receiving more inquiries about this aspect of their products.

Here, the ink is the focus. For example, Wittenberg says the inks in their 365 latex printers have the highest UL GREENGUARD level of certification. “Consequently, there are no restrictions on where the textiles can be used,” he says. “The ink is appropriate for LEED-certified buildings because there’s no off-gassing associated with it.”

According to Hunter, GREENGUARD certification has become an increasingly important selling point, especially for end users providing products to LEED buildings (although their inks aren’t LEED-certified, she adds). One eco-solvent printer Roland offers is the direct-print TrueVis SG-540, with GREENGUARD Gold-certified TrueVis ink. The printer can be used for apparel, signs, banners, graphics and décor.

Customization and personalization are other trends hitting end-user manufacturers, who are facing increased demand for logos, names and other branding applications, resulting in shorter, smaller print runs, says Wittenberg. He’s seeing more “versioning” as well. Essentially, this means having the same core message targeted toward different market segments or demographics, such as an advertising banner in English and the same one printed in Spanish.

Manufacturers are also seeking out specialty markets, where profits can be higher, says Phipps. “Virtually every show I go to, I see someone who has found a niche market and is building a business on something I never would have imagined was business-worthy,” he says. “One customer we have does dye-sub socks—hundreds of thousands of customized socks—using a small, wide-format printer. We’ve sold printers in applications from custom shoes to custom blinds and more. I’ve come to believe the only limitations are found in the imagination.”

Pamela Mills-Senn is a Long Beach, Calif.-based freelance writer.

With so many wide- and grand-format printers to choose from, and so many potential applications, determining the best fit for your business (and where you might want to take it) can be challenging. Michael Maxwell, senior manager of sign graphics business development and marketing for Mimaki™ USA, a Suwanee, Ga.-based manufacturer of digital printers and cutters, recommends buyers consider not just the printer’s specs but its core technologies.

“Customers should look for printers that include systems that keep them running with minimal operator intervention,” Maxwell says. Some features he suggests include nozzle checks for functionality and recovery, and bulk and automated ink replenishing systems.

Do your homework, advises Brian Phipps, president of Mutoh America Inc., a Phoenix, Ariz.-based manufacturer of wide-format printers. Start with what you want to do and work backward.

“Once they understand what they want to create, they can figure out the equipment needed to do the job,” he says. “There will be different levels of solutions, from less expensive to more industrial or heavy-duty, depending on how much quantity they need to make in a given amount of time.”

Check out trade shows, Phipps suggests. They’re a good way to research and connect with experts. And inquire about the training provided. “That may be one of the most important parts in reducing time to market and limiting cost and waste,” he says.

Wide-format printers, those with a width of 30 inches up to 64 inches, are playing a key role in the digital textile printing arena. These printers are allowing specialty fabricators to find new markets, giving them greater flexibility in what they offer and helping them operate more cost-efficiently.

To help their customers better manage the printing process, HP Inc. devised the HP Latex Mobile app, says Tom Wittenberg, market segment manager of Sign & Décor for the Americas. This provides users with status updates—such as when the run is done, or when ink is low—so they don’t have to stand by and monitor the printer; especially handy for smaller shops, he says.

Wide-format printers are upping the demand for larger-scale projects, says Kylie Schleicher, marketing manager for Ultraflex Systems Inc. Headquartered in Tampa, Fla., the company makes a range of soft-signage solutions for the wide- and grand-format markets. “For example, the latex printers increased the demand for fabrics in sizes close to 60-inch widths; the newer dye-sublimation equipment is creating a demand for 196-inch material,” she says. “The wide-format market is changing. There’s a shift in demand from solely inexpensive vinyl products to fabrics. With new and innovative materials constantly being produced, the demand in wide-format is growing,” says Schleicher.

TEXTILES.ORG

TEXTILES.ORG