Advanced textiles sector participants can benefit from strong growth predictions.

by Seshadri Ramkumar

The protective textiles sector is expected to grow at an annual rate of 4 percent, according to a recent report by Leeds, U.K.-based WTiN Intelligence Service. Earlier estimates by other market survey agencies, such as Grand View Research, estimated the annual growth rate to be 3.4 percent. These estimates show that the growth rate of the protective textiles sector is normally higher than the growth rates of GDP of developed economies, including those in Europe and the U.S., which, according to 2017 World Bank data, are 2.435 percent and 2.273 percent.

As GDP is an indicator of the economic strength and confidence of nations, to have an industry that has been constantly outperforming GDP growth rates is very much a positive indicator for that sector. Developing nations such as India, where the advanced textiles sector is nascent and growing, show higher growth rates. For example, India’s technical textiles sector, which encompasses the defense and protective textiles industry, is expected to have an annual growth rate between 11–13 percent.

These figures suggest that the protective textiles sector is in a worldwide growth trajectory, but there are many challenges. New entrants, particularly, may face a tough uphill battle, due to four main factors:

1. This is a defined and esoteric market;

2. Strict regulations;

3. Intensive R&D requirements; and

4. Marketing hurdles.

Road maps to growth

The protective textiles industry faces constant pressure to address a host of market demands. These can include functionality requirements, new and emerging threats in need of protective products, and the desire for improved performance and comfort. While this field is dominated by established industries, it can offer good scope for small- and medium-scale enterprises (SMEs). One way for new entrants to participate is to serve as a subcontractor or supplier to OEMs. This strategy has its advantages, offering less risk and more flexibility, which helps with R&D and the marketing pipeline.

Involvement with industry groups to promote and market the product is also valuable, yet this aspect has often been overlooked. Participating in industry associations, such as the Industrial Fabrics Association International (IFAI), Brussels-based EDANA and Cary, N.C.-based Association of Nonwoven Fabrics Industry (INDA), can help a business establish itself in the industrial and technical textiles field.

An important customer for advanced protective textiles sector is government, specifically defense. Current and future requirements are released by agencies via broad agency announcements and presentations at defense industry days. In the U.S., the nodal agency for chemical and biological defense is the Defense Threat Reduction Agency (DTRA). It’s worthwhile to establish communications with these agencies, to get a start in this field.

Protective textiles classifications

As the sector’s name indicates, it deals with non-commodity textiles; hence functionality becomes a priority as opposed to aesthetics. More importantly, while the market may be esoteric, the field is broad and protection can be offered by soft textiles, hybrids and composites to counter different threats at various threat levels. Using a broad perspective of the protective textiles industry, it can be categorized this way:

• Class 1: Protection based on end-users

• Class 2: Protection based on threat agents

The protective textiles industry based on end-users (Class 1) can be further divided into:

A. General consumer

B. First responders

C. Local law enforcement personnel

D. Warfighters

The level of threat normally increases from category A to C, and so do functional and quality requirements, as well as regulatory burdens. It does in no way mean that the threat to common consumers and general public is less serious, but there is a general understanding that higher level threats, such as those in war zones and combat, require highly functionalized personal protective equipment that’s governed by stringent quality standards.

Class 1. Threats to consumers’ health and the spread of disease is a serious issue worldwide, but new research is showing that a simple solution can have an important impact: single-use disinfectant wipes offer a simple means to counter common chemicals and microbes. These threat agents are normally transmitted due to daily activities in public settings.

Recently published collaborative research between scientists from the U.K. and Finland showed that plastic trays used in airports are a breeding ground for infectious viruses. This study was conducted in Helsinki’s Vantaa Airport, and studies like this show the need for common protective tools, such as nonwoven wet wipes impregnated with alcohol.

As with any consumer products, cost plays an important factor in buying decisions. Consumer protective textiles are price-sensitive, so the cost of manufacturing has to be controlled. This type of consumer product is made in a hydroentanglement nonwoven process, using polyester and viscose fibers to keep the cost under control. The functionality comes from the chemical component; the spunlace fibrous structure provides the integrity and the platform to add chemistry.

Common chemical formulations involve alcohol for consumer wipes and bleach for industrial and hard surface cleaning wipes. In the case of bleach, the formulation is normally hypochlorite, with an available active chemical of about 6 percent. Apart from these consumer protective wipes, another category is industrial wipes that are relatively heavier than consumer wipes. These can be made using a needlepunching process, which make them cost-effective.

Class 2 protective textiles are based on threat agents that they’re designed to address, and can be broadly separated into:

1. Defense textiles

2. Medical textiles

Within the defense category, subcategories include ballistic protection; chemical, biological and nuclear (CBN) protection; and thermal protection. Thermal protection is a broad field and involves protection for warfighters, firefighters and emergency personnel.

The medical category involves protection against microbes such as bacteria, fungi, viruses, bloodborne pathogens and bodily fluids. In a typical hospital setting, protective textiles can be generally grouped as textiles in the patient, on the patient and near the patient.

For medical textiles, testing standards, performance requirements, regulations and procurement procedures are stringent. New entrants to the field of protective textiles need to be cognizant of requirements by end-users and government agencies for specific uses. There are many, and they come from different agencies. In the case of ballistic clothing, for example, standards are aligned with regulations set forth by the National Institute of Justice (NIJ). In the case of chemical and biological countermeasures, the defining agency is the Defense Threat Reduction Agency in the U.S. (DTRA) and the Defence Research & Development Establishment (DRDE), Gwalior, India.

What’s next?

Designers of protective solutions from the advanced textiles sector should first understand the requirements of their end-users, whether public or government, and then start developing products to tackle either short- or long-term needs. Regular communication with government agencies is an important component, as research and product calls are issued by these agencies.

Developers in the textiles sector should be aware that answers to complicated threat scenarios can be tackled only through multi-disciplinary means. Industry-university partnerships become especially valuable, as there is a plentiful talent pool available in academia. The field offers enormous opportunities for SMEs to attract good research funds through a variety of mechanisms such the U.S. government’s Small Business Innovation Research program (SBIR). In the sphere of protective textiles in developed economies, both push and pull strategies can work.

Seshadri Ramkumar, Ph.D., is the director of the Nonwovens and Advanced Materials Laboratory, Texas Tech University, and a frequent contributor to Advanced Textiles Source.

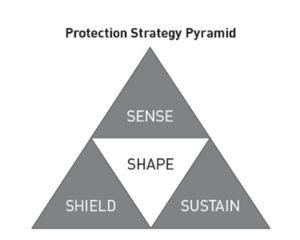

The U.S. Dept. of Defense has devised a strategy to develop protection tools against threats, and although focused on CBN defense, it can be applied to tackle all threats.

The U.S. Dept. of Defense has devised a strategy to develop protection tools against threats, and although focused on CBN defense, it can be applied to tackle all threats.

The threat countermeasures strategy includes: sensing the threat (sense), modeling and understanding the threat (shape), protection (shield) and cleaning/decontamination (sustain).

This strategy is known as 4S and is important for the industry to follow while developing protection equipment and tools. Also, from an R&D point of view, industry and research laboratories can focus on these four aspects to attract funding.

TEXTILES.ORG

TEXTILES.ORG