Your most valuable asset may be your business.

A business owner can spend decades building a business and reputation. As they approach retirement age, they likely have questions such as: How do they value their business? How do they maximize the value and minimize taxes upon sale or succession?

Determining value

So what is the value of your business? The simplest answer is whatever a willing seller and willing buyer will agree to. The challenge with this approach is you must put your business on the market to discover its value.

However, much like the real estate market, you can look at comparable businesses in the same industry and geographic area to see what they have recently sold for. You can find these businesses via sources such as brokers associations, Small Business Administration deal statistics or comparable factors from industry experts.

Another effective way to value your business is to look at a multiple of earnings. For mid- to larger-sized businesses, we at Boulevard Wealth Management review Earnings Before Interest Taxes Depreciation and Appreciation (EBITDA) and for small businesses, we evaluate Seller’s Discretionary Earnings (SDE).

Each shows the cash flow a buyer might receive when purchasing your business; the question is: How many years of those cash flows are they willing to pay to acquire your business? Determine a multiple by identifying the ratio of your company’s value to a specific financial metric. Mid- and larger-sized businesses tend to command a higher multiple, as they are less dependent on owners to keep operating. Here, we might look at three to five times EBITDA.

Smaller companies command a lower multiple because of their dependency on owners, and SDE includes owner’s compensation in the form of salary and benefits. These typically command a multiple of two to four times SDE—although it can vary greatly between industries. You can also undergo an independent valuation based on your industry. Boulevard uses Biz Equity business valuation software.

Boulevard ran a valuation on a textile business with $800,000 in revenue, $160,000 in net income and owner’s compensation equal to $100,000. This valuation came in at $776,794. Using the SDE as a reference point, this is about three times SDE—midrange.

Increasing value

So how might you drive up the value of your business? There are seven key areas of focus for business owners to maximize value:

- Track record: Do you have good and improving cash flow?

- Systems: How can you incorporate operating systems that improve the sustainability of cash flows?

- Revenue diversity: How do you demonstrate a solid, diversified customer base?

- Competitive advantage: Do you serve a niche market for which you are known?

- Financial controls: What are your cash flow projections and budgets, and are they adhered to?

- Scalability: How can you add revenue without adding expense at the same ratio?

- Management: How do you build a stable, motivated management team that stays after the owner leaves?

While these are big questions, it is recommended to examine your business to find the answers and determine where you can make improvements. Doing so may expand your net profit margin and multiple as well as increase the business’ value.

The previous example business had a net profit margin of 20% and a multiple SDE of three. If that net profit margin could expand to 30% and the multiple to four, the value of the business would increase to $1,360,000, or 72% higher. It would be well worth the effort.

Evergreen struggle with taxes

How do you minimize the taxes upon sale? One key way is to pay attention to how you structure the sale. You can structure it as a stock sale, asset sale or a combination of both.

As a seller, you want to lean toward a stock sale, which means you receive capital gains tax treatment upon sale. If it is an asset sale, you are subject to the recapture of depreciation on any assets you have depreciated at a higher rate than capital gains.

The buyer, on the other hand, will lean toward an asset sale so they do not assume any outstanding liability from your company and can depreciate the assets for tax purposes. Many sellers are unaware of this distinction, and it can become a key negotiating point.

Sale structure

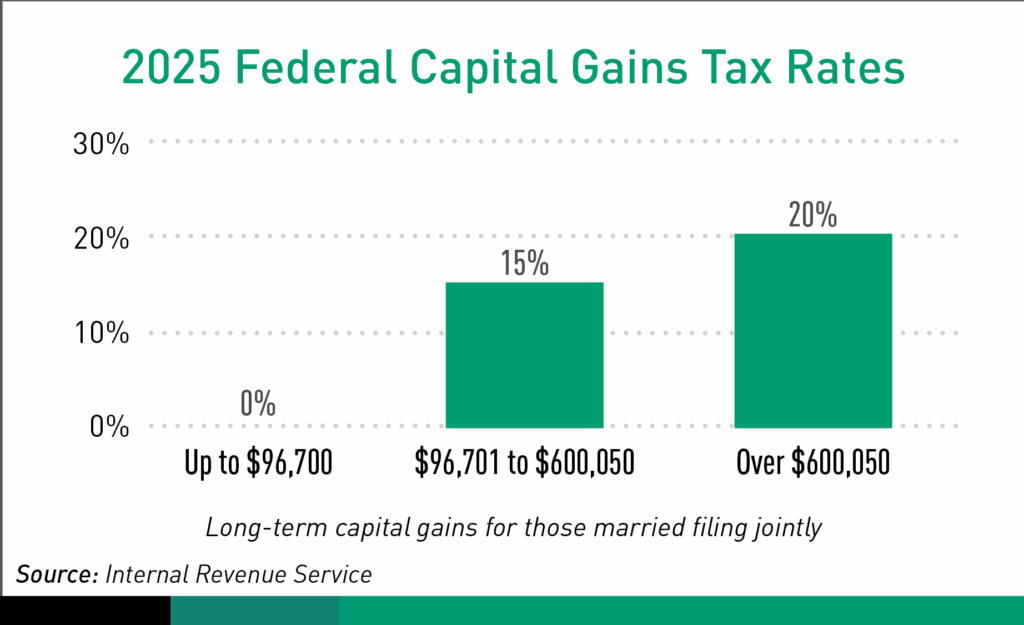

Another key way to minimize taxes upon sale is to structure it as an installment sale versus a lump sum. By doing so, the capital gains recognition is spread out over several years and if structured properly, can keep you in the lower capital gains tax rates. See the chart below for the 2025 federal capital gains tax rates for married filing jointly, according to the Internal Revenue Service.

Spreading out the capital gains means more gets recognized in the 0% tax bracket. In fact, if $96,700 is sufficient to meet your cash flow needs when you add in Social Security, it can pay to structure your note so you do not receive more than that in any given year.

Charitable options

You can also reduce tax liability by looking at charitable concerns and intent. If you have charitable concerns, there are two vehicles you can use to reduce tax liability upon sale.

The first is using a donor-advised fund (DAF). You can give a portion of ownership to a DAF, avoid the capital gains on that portion of the sale and get a charitable deduction for the fair market value of the gift. This can minimize the taxes on the sale of the remaining interest; it could also be coupled with an installment sale as you get a carryforward on the charitable contribution for up to five years.

The second charitable vehicle is a charitable remainder trust. In this structure, you can gift the entire business to the trust or sell it inside the trust, which avoids capital gains, and you get a charitable deduction for the gift.

Boulevard would structure the trust to have a payout over a several-year period—10 years is a good duration. By doing so, you receive an income stream for 10 years and the charity receives the remainder interest at the end of that time, which must be at least 10% of the initial contribution.

Advisors at Boulevard will often make a DAF the charity at the end of the term, which gives you flexibility over the final recipient of the charitable funds; you could set up the equivalent of a family foundation for charitable concerns.

Whether it’s sale structure or using charitable vehicles, these are complex strategies with major pitfalls for pass-through identities. Before considering any of these options, you should consult with your tax advisor and legal counsel.

Hopefully, this framework to determine, drive up and conserve more of your business’ value will help you navigate this chapter of business ownership with grace and be properly rewarded for your life’s work.

Troy Noor, CFP®, CFA is the executive director of Boulevard Wealth Management. He has nearly three decades of experience helping business owners unlock, preserve and perpetuate the wealth in their businesses to have impact on families and communities for generations.

ATA members can request an informal business valuation to help ensure their business is protected for both planned and unplanned events.

Do you have any advice for your colleagues on selling a business? Share your tips on CONNECT.

TEXTILES.ORG

TEXTILES.ORG