Despite some slowing of global GDP in 2016, growth of the U.S. and Canadian specialty fabrics industry is slow but steady, and markets like fabric structures, tent rental and manufacturing, fabric graphics and marine fabrication are outpacing national averages. The pace is expected to continue, but can also be somewhat constrained by changes in unemployment rates, consumer spending and low oil prices, which have already started to show moderate increases.

The world economy in review

In IFAI’s 2016 State of the Industry report, one main concern focused on China’s growth prospects as the country struggled with attempts to rebalance demand more toward the domestic economy versus an overreliance on exports for the products China produces and delivers to the rest of the world. Currently, stable growth performance has reduced short-term concerns about China.

In the years ahead, the global economic forecast is expected to show slowly improving gradual growth. Projected improvement will be driven by emerging markets and developing economies, as conditions in stressed economies gradually normalize. For example, after two years, China’s monetary and fiscal stimulus measures—such as cutting lending rates and increasing government spending—are finally translating into stronger economic activity. Although China’s GDP growth rate is declining, it remained high at 6.6 percent in 2016, down from 6.9 percent in 2015. It’s expected to decrease a little more in 2017—declining to 6.2 percent growth in GDP.

Economic growth in 2016 has declined or remained the same in key advanced economies such as the United States, Japan and Europe. Larger emerging economies, with the exception of India, face slow growth prospects in 2017— particularly in China and Russia.

Worldwide growth in GDP came in at 3.1 percent in 2016—slightly below the 3.2 percent growth realized in 2015; it is expected to recover to 3.4 percent in 2017. Growth in U.S. GDP in 2016 was 1.9 percent, down seven-tenths of a percentage point from 2015. The U.S. economy lost its momentum in the first half of 2016, and the expectation of a pickup in the second half of 2016 never materialized, with the exception of the third quarter. Even though growth was slow in 2016, consumer spending remained strong, supported by a firm labor market and expanding payrolls. The weakness in business investment underscores the impact of factors such as declining capital spending in market segments like energy, the strength in the U.S. dollar and its negative impact on U.S. exports to overseas markets.

Although the U.S. labor market is strong—with employment and wages rising—this is an uncertain time for many people in the U.S., stemming from developments such as the election of Donald Trump and the continued threat of terrorism.

The European economies appear to be sluggish as well, and there is increased pessimism about continued expansion in Europe. GDP growth in the 19-nation Eurozone was 1.7 percent in 2016 and is expected to decline to 1.5 percent in 2017. In the U.K., confidence remains upbeat— thanks to high employment, limited inflation and low prices. Speculation that consumer confidence would plummet in the aftermath of the Brexit vote has not yet been fulfilled. As in the U.S., terrorism was a strong concern for Europeans in 2016 and remains so in 2017.

KEY U.S./CANADIAN MARKETS

The Industrial Fabrics Association International (IFAI) serves the global specialty fabrics industry. For this report, participants in 11 U.S. and Canadian markets were researched and surveyed. Five of those markets will be covered in this report: awnings and canopies, marine, tent manufacturing and tent rental, fabric structures and fabric graphics.

The remaining six markets will be covered in Part II of this report, in the March issue: the military, advanced textile products, narrow fabrics, geosynthetics, tarps and truck covers, and equipment.

U.S. AND WORLD MARKETS OVERVIEW

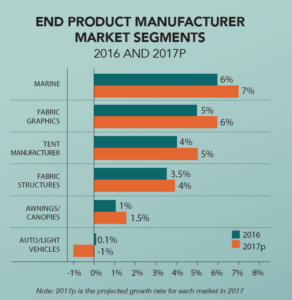

All but one of the traditional end product market segments IFAI monitors achieved single-digit sales growth in 2016. (The military market was down 6 percent.) The marine fabrics market tops the list of market segments—growing at 6 percent in 2016. Investing in state-of-the-art equipment, lean/quality improvement manufacturing practices, training staff, and developing and marketing innovative products directly targeted to customers have boosted sales in 2016 for many organizations within the specialty fabrics marketplace.

The world market for specialty fabrics grew approximately 2.6 percent in 2016 and is expected to achieve sales growth of 2.7 percent in 2017. Constraints on global growth in the 2016 specialty fabrics market were largely attributable to a slower growth rate of 3.1 percent in worldwide GDP. The decline in world GDP in 2016 reflects a noticeable slowdown in the economies of emerging markets like China; the downshift in China’s economy was offset by strong consumer spending in the United States.

Growth in the U.S. specialty fabrics industry was approximately 2.3 percent in 2016, and is expected to reach 2.6 percent in 2017. The 2017 growth rate will depend on the continuation of a low unemployment rate at or below 5 percent, a continued increase in consumer spending above 2 percent, and continued low oil prices.

Despite the improvements in the unemployment rate in 2016, consumers are still very cautious about their spending habits, and continue to worry about job security and how to make ends meet financially. Nonetheless, we do expect to see a 2.3 percent increase in consumer spending in 2017—as more people are confident that the U.S. economy will continue to expand at a consistent, gradual pace.

AWNINGS AND CANOPIES

In 2016, growth was up 1 percent in the U.S./Canadian end product manufacturer (EPM) awning and canopy market. Factors contributing to the growth included an increase of 4.8 percent in housing values in 2016 and an expected increase of 3.5 percent in 2017. New home sales soared 17.8 percent in 2016; they are expected to maintain that momentum with a growth increase of 15 percent in 2017. Housing starts are expected to increase by 18 percent in 2017 to 1.3 million—after an increase of 15.3 percent in 2016.

Many homeowners are expected to use their rising home equity to remodel their homes in 2017. According to the National Association of Home Builders Remodeling Market Index (RMI), the RMI figure for fourth quarter 2016 was 53. (An RMI above 50 indicates that more remodelers report that market activity is increasing than those reporting that it is declining.) Remodelers across the U.S. are seeing increased demand for major and minor jobs and calls for bids.

Construction activity increased moderately in 2016. Total U.S. construction was up 4.4 percent over 2015; residential construction was up 5 percent over 2015, and nonresidential construction was up 4 percent in 2016. (Nonresidential construction is the aggregate of individual construction market segments such as lodging, office and commercial projects.)

For 2016, total fabric consumed for awnings and canopies by U.S./Canadian end product manufacturers reached 29.6 million square yards—a 1 percent increase over 2015. For 2017, IFAI projects approximately a 1.5 percent increase in fabric consumption by U.S./Canadian awning and canopy manufacturers. Total sales are forecast to reach 30.0 million square yards.

In 2015 and 2016, the U.S. and Canada had good weather conditions in April through June. The result was a longer selling season for awnings, which translated into a slight improvement in awning sales in 2016—despite the anemic U.S. economy. Over the past few years, the trend of increasing sales of metal awnings has cannibalized sales away from fabric awnings. In 2016, metal awnings represented about 18 percent of all awnings sold in the U.S.; fabric awnings represented about 80 percent, with the remaining 2 percent of sales made from other materials.

OUTLOOK FOR THE AWNING/CANOPY FABRIC MARKET

In September–October 2016, a survey was administered to U.S. and Canadian awning suppliers and end product manufacturers. Seventy percent of the suppliers and end product manufacturers surveyed reported that compared to sales in 2016, the outlook for the awning and canopy business will be somewhat better in 2017. This year, an almost 4 percent increase in home values, unemployment under 5 percent, and (weather permitting) an earlier start to the awning selling season should lead to a 1.5 to 2 percent increase in sales in the U.S./ Canadian awning/canopy market.

MARINE

New boat sales increased 6-8 percent in 2016, in terms of units. An estimated 958,000 pre-owned boats (powerboats, personal watercraft, sailboats) sold in 2015, up 1.9 percent over 2014.

Developments in 2016 supporting future growth in the marine fabric market:

• A sunny and warm summer helped to bolster seasonal boat sales

• New boat retail sales (in U.S. dollars) growth in the 8–9 percent range

• A noticeably improving housing industry—housing prices across U.S. rose 4.8 percent

• A stronger job market— unemployment rate at 4.9 percent in 2016 vs. 5.3 percent in 2015

• A consumer confidence index above 90 for 2015 and 2016—a figure that historically correlates to a well-performing marine fabric industry

• Consumer spending of 2.6 percent; consumer spending is expected to be 2.3 percent in 2017

• Lower oil/gas prices in 2016 spurred increased consumer spending on recreation

Low fuel prices are expected to continue through 2017, a bolster for the consumer’s financial outlook that bodes well for new and pre-owned boat sales. Continued growth in recreational boating is projected to last until at least the middle of 2018. Buttressing this growth is the trend of more people in the U.S. taking to the water; some 89 million Americans went boating in 2013. This figure is approaching 90 million people who participated in recreational boating at least once in 2016.

OUTLOOK FOR THE MARINE FABRIC MARKET

Sales, in terms of volume, in the 2016 U.S./Canadian marine fabric end product market grew 6 percent to 28.2 million square yards. Sales are projected to grow 7 percent in 2017—reaching 30.2 million square yards. Gradual improvement in the U.S. and world economy in 2017 will be a key driver in fueling growth in the marine fabric market. U.S. GDP is expected to improve from 1.9 percent in 2016 to 2.1 percent in 2017. Support for growth in the U.S. will also stem from the strong 7–8 percent growth in new boat sales in 2017. New boat sales growth outside of the U.S. is projected to be in the 3–5 percent range—with certain segments growing faster than others.

The Conference Board’s consumer confidence index, a key barometer for growth in the marine fabric market, averaged 99.9 in 2016, which was 2.1 points higher than the 97.8 figure in 2015. This growth is expected to continue into 2017; in general, a consumer confidence index of 90 or more correlates to increased consumer spending—especially in the marine fabric market.

Future challenges for the U.S. marine industry include attracting younger, more diverse audiences such as millennials, minorities and women to boating, and ensuring that marine recreation stands out and maintains its appeal in a crowded leisure marketplace. Innovation has driven and will continue to drive growth in the boat business. New boats now are offered with advanced propulsion systems, tech-savvy features like Wi-Fi, and sleek new hull and deck designs, as well as attractive, comfortable and durable interior features and fixtures. These innovative and value-added products and technologies all contribute to building a better boating experience for customers; they’re designed to attract and maintain new, technology-embracing diverse customers who will help keep the marine industry thriving for years to come.

FABRIC GRAPHICS

In 2016, total fabric consumed by U.S. and Canadian fabric graphics fabricators reached 41.6 million square yards, up 5 percent over 2015. For 2017, consumption in the U.S./ Canadian fabric graphics market is forecasted to reach 44.1 million square yards, up 6 percent over 2016.

TRENDS AND OPPORTUNITIES

In the September-October 2016 fabric graphics survey by IFAI, respondents reported they think the U.S./Canadian fabric graphics market will be somewhat better in 2017 than it was in 2016.

Some key trends and opportunities for spurring sales in 2016-2017 were cited by participants:

• Overall general good growth throughout the industry

• Dye sub transfer remains the leading imaging process in the U.S./Canada

• More digital inkjet printers for fabric are being used, which has helped propel growth in latex print and ink technology

• Continued increase in silicone edge graphics (SEG) frame systems, which has helped to increase backlit/frontlit fabric signage growth

• Previously neglected fabric awnings are being re-covered, despite some municipalities adopting ordinances limiting graphics on awnings

• The retail segment continues to expand the soft signage market—both indoor and outdoor signage; there continues to be more sales of high-end point-of-purchase (POP) substrates

• Similar to the tent market, end product manufacturers report shorter lead times being demanded by customers for their projects; more print shops are having to bring in temporary staff in order to complete projects on time

• Strong growth was reported for graphics printing in the home and industrial décor market sector

• The trade show and exhibition market continues to realize double-digit growth

• Inexpensive imports from Asia— particularly China—are still having an impact

Slow growth in the U.S. economy led to the ongoing use of low-pricing tactics among some print shop operators in 2016; such tactics helped them to increase sales but hurt them in terms of reduced profit margins. Despite these low pricing tactics by some players in the marketplace, many print shop operators resisted from passing along price increases to their customers for fear they’d lose business to price-cutting competitors.

OUTLOOK FOR THE FABRIC GRAPHICS MARKET

There will be positive growth in many fabric graphics market segments in 2017, including retail, point-of-purchase (POP), trade shows and exhibitions, décor and wall coverings. Double-digit growth will continue in soft signage—especially POP signage in retail settings. Soft signage is becoming the preferred choice in many print applications versus flex face and rigid materials.

FABRIC STRUCTURES

The U.S./Canadian fabric structures market experienced growth of 3.5 percent in 2016 and is expected to grow 4 percent in 2017. Although U.S. GDP decreased to 1.9 percent in 2016, it is expected to rebound to 2.1 percent in 2017. Consumer confidence and subsequent demand continued to increase in 2016; both are expected to maintain an upward trajectory through 2017. These economic barometers signify increasing demand in the U.S. fabric structures market in 2017 and beyond. In 2016, the size of the U.S./ Canadian fabric structure market was 10.5 million square yards at the end product level; that figure is expected to reach 10.9 million square yards in 2017.

TRENDS AND OPPORTUNITIES CITED FOR SPURRING SALES IN 2016-2017

Fabric structure manufacturers surveyed by IFAI in October 2016 reported a number of industry opportunities and challenges.

• More projects being used in infrastructure development—for example, stadiums, shade structures at transportation depots, bus stops

• Increasing breadth of fabric structure applications—auto dealerships and outdoor sporting events

• A continuing increase in demand for engineered structures

• Continued replacement of aging structures

• The quality of fabrics continues to improve—fabrics having longer life spans, retaining color longer after repeated exposure to rain and UV radiation

THREATS CITED AS POSING AN IMPEDIMENT TO IMPROVED SALES IN 2016-2017

• There remain too many companies that manufacture fabrics and make false claims about them—in turn, they sell poor quality fabric structures, with a high proclivity to fail. Although this problem has improved in recent years, it has tarnished the reputation of fabric structures in the minds of some customers

• Strict, hard to interpret U.S. building codes increase the cost of business

• The continuation of inexpensive imports of readymade shades from Asia—particularly China

OUTLOOK FOR THE FABRIC STRUCTURES MARKET

In a September-October 2016 fabric structures survey by IFAI, respondents reported they think the U.S./Canadian fabric structures market will be somewhat better in 2017 than it was in 2016. The fabric structures market has realized a steady stream of growth at or above 3 percent since 2014, with annual growth rates ranging from 3 percent in 2014 to a projected growth rate of 4 percent in 2017. Product awareness is growing as building structure customers are realizing the aesthetic quality and economic advantages that fabric structures provide, which can’t be matched by traditional materials.

TENT RENTAL AND MANUFACTURING

With thousands of companies competing for event organizers to rent tents and tent-related equipment, this is a very competitive market. In terms of volume, sales for the U.S./Canadian end product manufacturer (fabricator) market were 24.1 million square yards in 2016, up 4 percent over 2015. Sales are projected to be 25.3 million square yards in 2017, up 5 percent over 2016.

The party and event rental market grew 6 percent in 2016, and is expected to grow by 7 percent in 2017. The corporate event market improved in 2016; it’s estimated to have grown 5 percent in 2016 and should reach 5 percent growth again in 2017. The scope of corporate events continued to expand in 2016 as budgets increased.

TRENDS IN TENT RENTAL

Key trends in the tent rental market in 2016:

• Better weather in the spring and summer of 2016 contributed to an increase in the number of events held in 2016—especially outdoor events for weddings and corporations

• There is more demand for tent liners, flooring and lighting, which has helped increase revenues for event operators in the last few years

• Shorter lead times are being demanded by customers for their events; tent operators often have to work harder and bring in more temporary staff in order to complete events on time

• Exacerbating the pressure of shorter lead times on tent operators is the challenge they face due to a shortage of trained and talented staff available. These pressures are compounded by the increase in customer demand for more elaborate event set-ups

• Sailcloth tents remain popular; they are visually appealing with sculpted peaks and eaves that create a feel of open space at outdoor events

• Government regulations and permitting continue to increase; event operators report they are spending too much time acquiring the proper permits to remain in compliance with building codes

• Customers are increasingly tapping into social media for ideas to create a very specific look and feel for their events to fulfill very specific customer requests. It can be difficult to carry enough inventory to satisfy every request from the customer

OUTLOOK FOR THE TENT RENTAL MARKET

Over the last few years, tent event operators have done a better job of marketing their tents and accessories to their customers; they’ve expanded traditional marketing schemes by stepping up usage of social media and the internet. Commercial and party event customers are spending more money on expanding the scope of events, compared to the previous few years. In 2017, weather permitting, look for corporate and party events to maintain their journey toward healthy growth—5 percent for the corporate market and 7 percent for the party events market.

INDUSTRY OUTLOOK

The global economy is in the throes of a decade-long slow growth environment. The looming labor shortage in mature economies and skill deficiencies in emerging markets will add further challenges to worldwide economic growth prospects.

The slow growth in GDP in several countries worldwide could last another 5-6 years. With the continuing malaise in economic growth in economies across the world—including China—it has become very difficult for specialty fabrics industry participants to expand their businesses; overall expansion of the specialty fabrics industry has become a challenging situation for all of its players in 2017 and beyond.

Going forward, the survivors and future industry pioneers in the specialty fabrics industry must continuously innovate—delivering cutting-edge technologies and products to the marketplace. Manufacturers that do not embrace the innovation mantra risk becoming irrelevant to their customers—and may ultimately end up being absorbed by another organization or going out of business altogether.

While growth in the U.S./Canadian specialty fabrics industry has been held in check by the economic woes of the world since 2009, it has held its own compared to other industries. Small- to mid-sized companies have found their niches in areas such as medical products, safety and protective products and specialized military markets. Specialty fabrics suppliers and end product manufacturers have become more price-competitive with imports; this has been largely due to innovation in equipment, which has enabled them to rely less on labor. But it is also true that labor costs are rising overseas as well. In fact, more and more manufacturers that moved their production overseas in the past are starting to return some of their operations to the United States and Canada.

Industry participants interviewed at IFAI Expo 2016 said that they are optimistic about sales prospects for 2017; they feel the U.S. economy will be noticeably improved compared to 2016, with more job growth. Unemployment is projected to reach 4.6 percent next year, versus 4.9 percent in 2016. Consumer spending is also expected to remain above 2 percent, reaching 2.3 percent. These economic tailwinds are expected to help bolster greater consumer confidence, resulting in increased consumer spending on specialty fabrics in 2017.

2016/2017P U.S.-Canada Market Growth Rates for selected specialty fabric end product manufacturer markets

2016/2017P U.S.-Canada Market Growth Rates for selected specialty fabric end product manufacturer markets

Auto/light vehicles unit sales growth figures are U.S. only. All figures for other markets are based on consumption—millions of square yards. Growth rates were up in 6 of 6 market segments (including vehicles, as shown above) in 2016 versus 2015. Five of the six end product markets are projected to achieve positive growth in 2017, compared to 2016 in the U.S./Canada. The exception is the auto/light vehicles market, which is expected to decrease 1 percent in 2017.

TEXTILES.ORG

TEXTILES.ORG

Nice report, Jeff.

Excellent work Jeff, keep it coming!