More than a year after the declaration of a global pandemic, it’s no surprise that a majority of companies in the industrial fabrics industry were negatively affected by the events of 2020. But the struggles were uneven, with some companies pivoting to new markets and others experiencing a positive effect.

Industrial Fabrics Association International (IFAI) conducted the “COVID-19 Business Impact in 2020” survey in late December 2020 and early January 2021 to help understand how businesses in the textile industry were affected by the pandemic.

“The results of the survey validate what we’ve heard from IFAI members over the past 11 months,” says IFAI President/CEO Steve Schiffman. “Member companies that were deemed essential, those that moved quickly into new markets and those that supply the necessary products saw a positive impact on their business.”

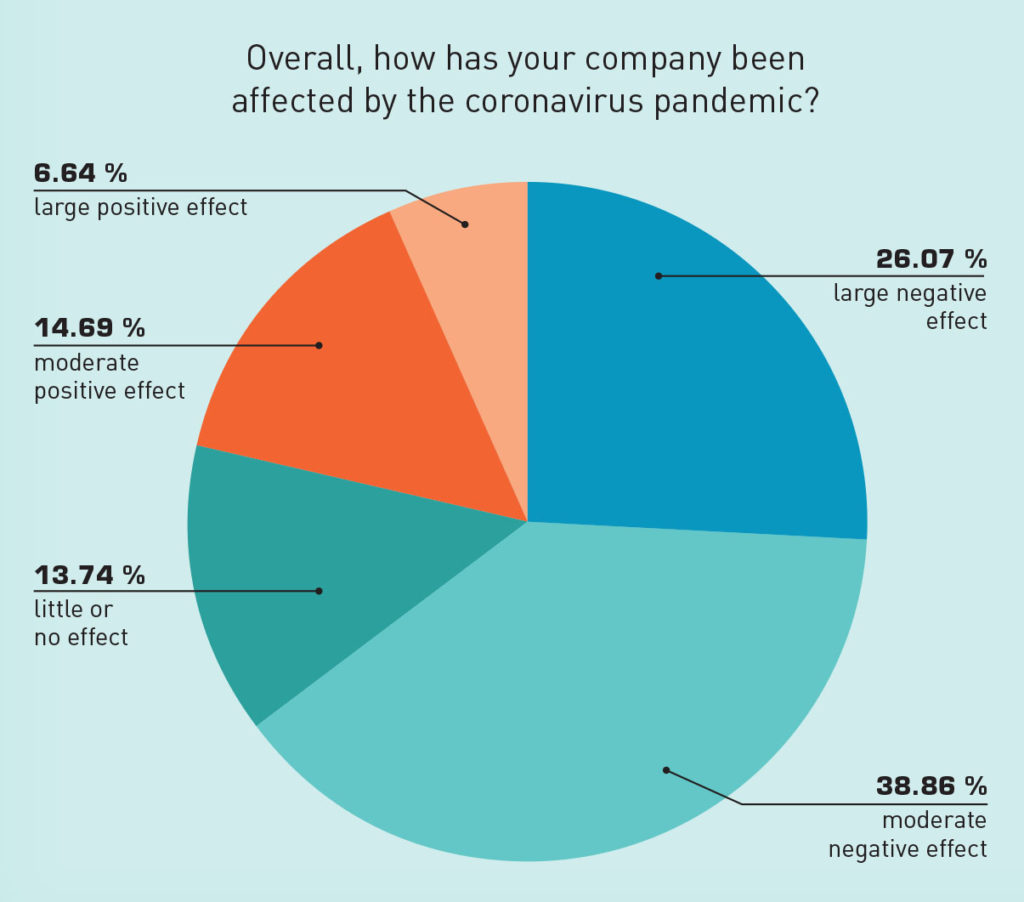

According to the survey, nearly two-thirds (65 percent) of the 212 respondents said that the pandemic had either a moderate or large negative effect on their business. In contrast, 21 percent reported that the events of 2020 had a moderate or large positive effect on their business. (See Fig. 1)

With medical textile products in sudden high demand, a quarter of respondents pivoted to the personal protective equipment (PPE) market in 2020. This included suppling the components for and manufacturing masks, gowns, gloves, barriers, curtains, chinstraps, body bags, quarantine flags, graphics for social distancing, and tents and shelters. Just more than 10 percent reported that they expect the pivot to be a permanent change for their business.

“Pivoting production, complying with medical specifications and sourcing new materials in a global emergency are just a few obstacles companies faced,” says IFAI Divisions Manager Janelle Wells Buerkley. “Businesses throughout the markets needed to strategize to combat supplier delays, workforce shortages and financial challenges. This agility is a testament to the resilience of the industry and a hopeful 2021.”

The tent rental and event industry has been particularly hard hit. While the pre-pandemic industry forecast looked “rosy,” according to IFAI Tent Rental Division (TRD) Steering Committee Chair Michael Tharpe, national sales manager, Rainier Industries Ltd., Tukwila, Wash., the mass cancellation of events starting in mid-March turned everything “upside down.”

“The economic conditions created by the pandemic were far-reaching,” he says. “Production was brought to a temporary halt, purchasing decisions were delayed, stocking levels were reduced in order to survive. Basically, the pandemic created an entire shift in our ability to produce because we did not know what to produce until new markets prevailed.”

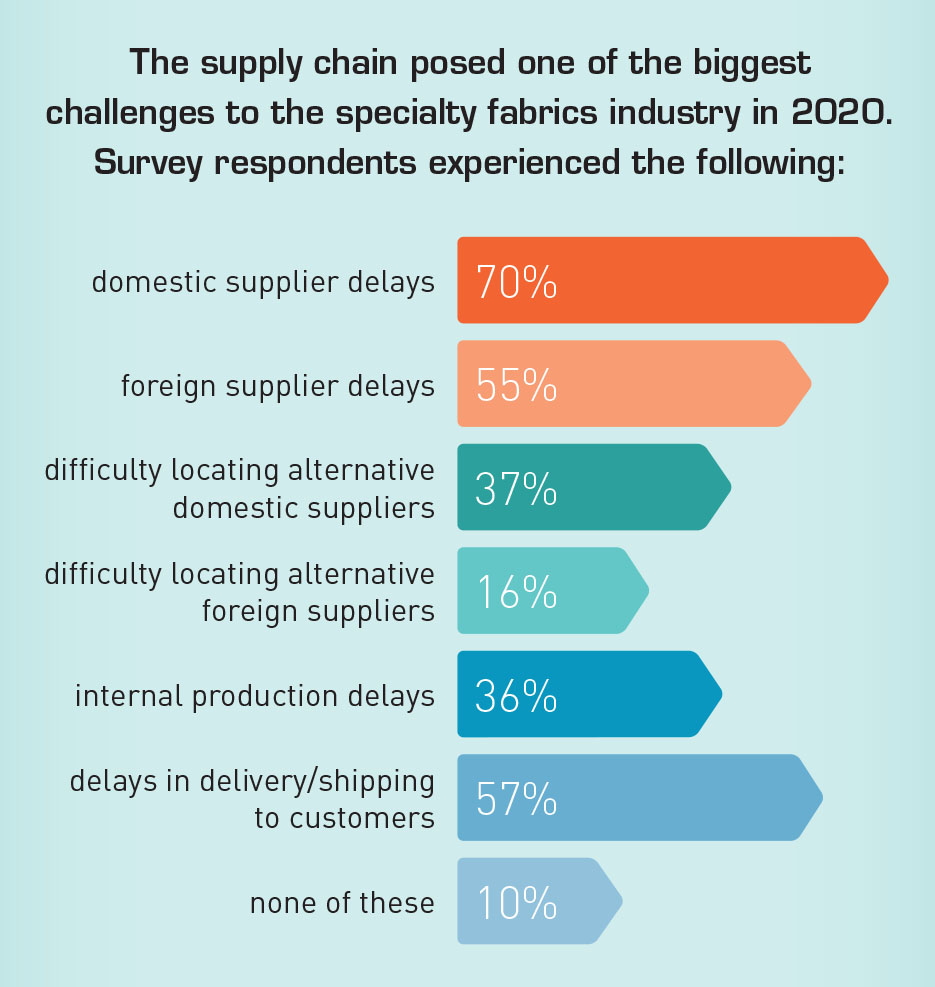

Supply chain disruptions

As has been reported in Specialty Fabrics Review and other industry sources for the past year, supply chain disruptions have been among the major challenges of the pandemic across nearly all industry segments, affecting small shops and large manufacturers alike. More than 70 percent of respondents reported domestic supplier delays, while less than 10 percent reported no issues with suppliers, internal production delays or delivery to customers. (See Fig. 2.)

Labor and productivity challenges

With shops facing shutdowns (if not deemed essential) and some markets collapsing, nearly 42 percent of survey respondents furloughed or laid off employees after March 13, 2020, when the pandemic was declared a national emergency in the U.S. However, nearly 29 percent were able to recall or rehire at least some of those employees later in the year.

Nearly 55 percent of survey respondents reported that their business’s operating capacity was affected by employees quarantining due to a positive COVID test or potential exposure. Other challenges to operating capacity included:

- the availability of employees because of pandemic-related issues, such as lack of childcare: 42 percent

- physical distancing of customers or clients: 37 percent

- physical distancing of employees: 35 percent

- the ability of employees to work from home: 32 percent

- the ability to rehire laid off/furloughed employees and/or hire new employees: 20 percent

“Lead times for raw materials were extended, production lines were taxed to meet [new demands created by the pandemic] and quarantine became the new common factor as employees or their families tested positive for the virus,” Tharpe says. “Social distancing and cleaning time was stressed to become more efficient in order to remain productive.”

U.S.-based companies turned to the federal Paycheck Protection Program (PPP) to help keep their workforce employed during the pandemic, with 56 percent of respondents receiving financial assistance through the program. Nearly 19 percent received help from the Economic Injury Disaster Loans (EIDL) program, designed for businesses experiencing a temporary loss in revenue. Some 15 percent received financial assistance from state or local governmental programs, while 10 percent benefitted from the Small Business Administration (SBA) Loan Forgiveness program.

2021 outlook

Looking into 2021, 34 percent of survey respondents plan to identify new supply chain options. In addition:

- 43 percent expect to identify and hire new employees

- 28 percent expect to develop online sales or websites

- 25 percent expect to obtain financial assistance or additional capital

- 20 percent expect to purchase equipment to automate workflow

Only three percent of respondents were expecting to close their business in 2021.

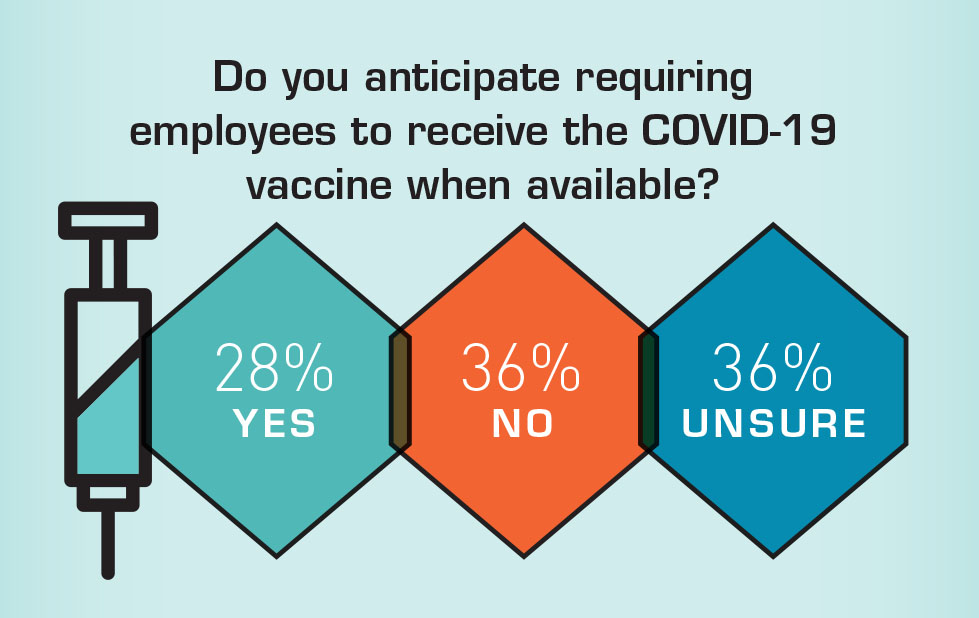

Finally, with vaccines just beginning to be distributed to frontline workers at the time the survey was conducted, respondents were split on whether to require their employees to be vaccinated. (See Fig. 3.)

Industry leaders interviewed in the March 2021 special “COVID” edition of Specialty Fabrics Review expressed “cautious optimism”—citing such factors as a growing interest in equipment investments and automation, the emergence of new markets and the potential to extend Berry Amendment-style support to PPE manufacturing.

According to Tharpe, that optimism extends to the tent and event industry. “Many feel that it will be a slow process and business will gradually come back stronger in the third quarter of 2021,” he says. “The vaccination process will aid the comeback and hopefully take away many of the restrictions that we have been dealing with. A big smile for us as suppliers to the industry.”

TEXTILES.ORG

TEXTILES.ORG